Global Color Resist Materials Market to Reach USD 4.1 Billion by 2031 at 4.8% CAGR

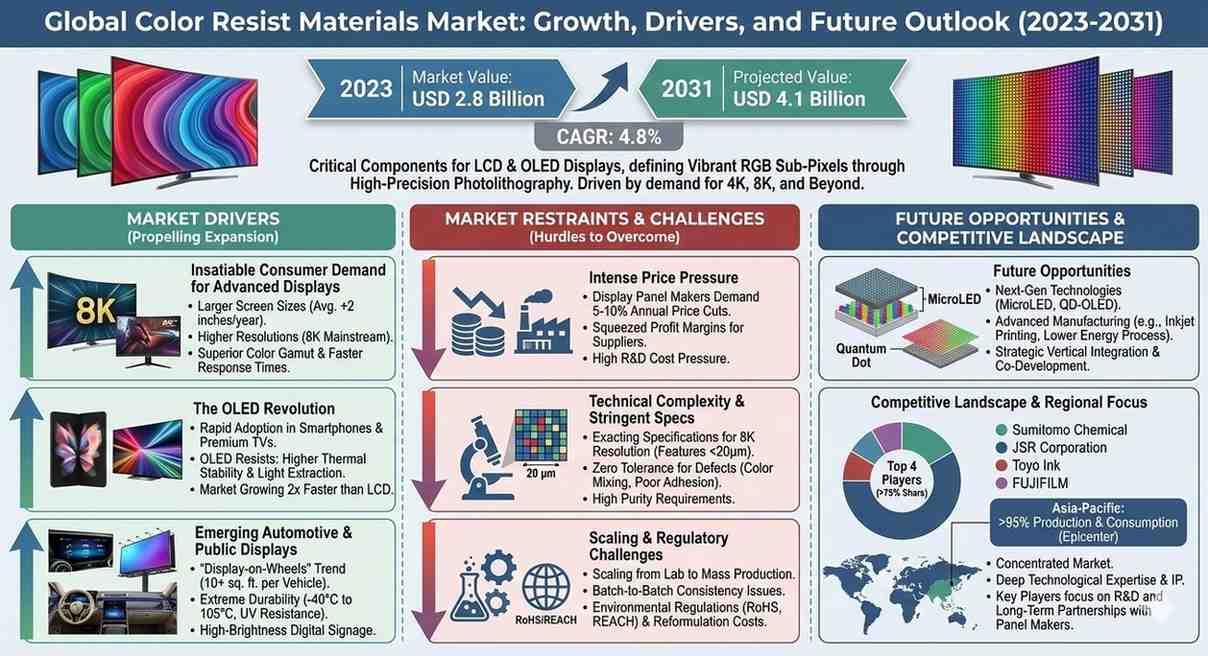

Global Color Resist Materials market was valued at USD 2.8 billion in 2023 and is projected to reach USD 4.1 billion by 2031, exhibiting a steady CAGR of 4.8% during the forecast period.

Color resist materials are critical components in the manufacturing of liquid crystal displays (LCDs) and organic light-emitting diode (OLED) panels, serving as the colored filters that define the vibrant red, green, and blue sub-pixels. These high-precision photopolymer formulations must exhibit exceptional properties, including high color purity, thermal stability, chemical resistance, and precise patternability via photolithography. The relentless demand for higher resolutions, such as 4K, 8K, and beyond, has pushed material scientists to develop resists with ever-finer pixel definitions and superior light efficiency, making these materials a cornerstone of the modern display industry.

Get Full Report Here: https://www.24chemicalresearch.com/reports/232753/color-resist-materials-market-2023-2031-720

Market Dynamics:

The trajectory of the Color Resist Materials market is shaped by the powerful, contrasting forces of innovation in the display sector against the backdrop of cost pressures and shifting regional manufacturing landscapes. It's a market where technological advancement is the primary currency.

Powerful Market Drivers Propelling Expansion

- Insatiable Consumer Demand for Advanced Displays: The global shift towards larger screen sizes, higher resolutions (with 8K panels now entering the mainstream), and superior color gamut coverage (exceeding 90% of DCI-P3 standard) is a fundamental driver. The television segment, which consumes over 45% of all color resists, is particularly influential, with average screen sizes increasing by nearly 2 inches per year. Furthermore, the proliferation of high-refresh-rate gaming monitors and professional-grade creative displays demands color resists with faster response times and minimal color shift, pushing material performance to new limits. This relentless pursuit of visual fidelity directly translates into sustained demand for next-generation color filter materials.

- The OLED Revolution and its Material Implications: While LCD technology still dominates by volume, the rapid adoption of OLED displays in smartphones, tablets, and high-end televisions represents a significant growth vector. OLED color resists differ from their LCD counterparts, requiring higher thermal stability to withstand the encapsulation process and enhanced light extraction properties to maximize efficiency. The market for OLED color resists is growing at nearly double the rate of the overall market, fueled by the technology's superior contrast ratios and form factor flexibility. As OLED manufacturing yields improve and costs decline, the demand for specialized, high-performance resists is set to accelerate significantly.

- Emerging Applications in Automotive and Public Displays: The automotive industry's transformation into a "display-on-wheels" is creating a robust new market. Modern luxury vehicles now incorporate over 10 square feet of display surfaces, from digital dashboards to central infotainment screens and passenger entertainment systems. These applications demand color resists with exceptional durability, able to withstand extreme temperatures ranging from -40°C to 105°C and intense UV exposure without degradation or color fading. Similarly, the market for large-format public information displays and digital signage, which requires high-brightness and long-life materials, is opening up substantial new avenues for growth beyond traditional consumer electronics.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/232753/color-resist-materials-market-2023-2031-720

Significant Market Restraints Challenging Adoption

Despite the strong underlying demand, the market must navigate a series of complex challenges that impact profitability and adoption rates.

- Intense Price Pressure from Display Panel Manufacturers: The display panel industry is characterized by fierce competition and cyclical overcapacity, leading to relentless pressure on component costs. Panel makers routinely demand annual price reductions of 5-10% from their material suppliers, including color resist manufacturers. This price erosion squeezes profit margins, forcing material companies to achieve continuous efficiency gains in their manufacturing processes. The high R&D cost associated with developing new formulations for each successive generation of display technology further exacerbates this financial pressure, creating a challenging environment for sustained innovation.

- Technical Complexity and Stringent Performance Specifications: Meeting the exacting specifications of modern display fabs is a formidable challenge. For instance, achieving the pixel definition required for 8K resolution on a 65-inch TV involves patterning features smaller than 20 micrometers with near-perfect edge acuity. Any defects, such as color mixing, poor adhesion, or uneven thickness, can lead to significant yield losses for the panel maker. The need for ultra-high purity raw materials and tightly controlled manufacturing environments adds considerable cost and complexity, creating a high barrier to entry for new market participants and limiting the supplier base to a few highly specialized companies.

Critical Market Challenges Requiring Innovation

The transition from one display generation to the next presents an ongoing set of technical hurdles that require constant innovation and investment.

Scaling up new material formulations from laboratory samples to mass production volumes of thousands of tons per year is a non-trivial endeavor. Consistency is paramount; batch-to-batch variations in viscosity, pigment dispersion, or photosensitivity can disrupt high-speed panel production lines, leading to substantial financial losses. Furthermore, the rapid pace of display technology evolution means that the commercial lifespan of a specific color resist formulation is often shorter than the time required to recoup the initial R&D investment. This creates a "innovation treadmill" where companies must continually invest in next-generation materials even as current products are still being ramped into production.

Additionally, the industry faces growing environmental and regulatory challenges. Stricter global regulations, such as the EU's RoHS and REACH directives, continuously restrict the use of certain chemicals and heavy metals traditionally employed in pigment and resin systems. Reformulating products to meet these evolving standards while maintaining performance requires significant R&D resources and can impact material costs and availability, adding another layer of complexity to the supply chain.

Vast Market Opportunities on the Horizon

- Next-Generation Display Technologies (MicroLED, QD-OLED): The ongoing development of emerging display technologies presents immense opportunities. MicroLED displays, which offer superior brightness and longevity, require entirely new color conversion layers where advanced color resists play a vital role. Similarly, Quantum Dot-enhanced OLED (QD-OLED) technology combines the perfect blacks of OLED with the color volume and brightness of quantum dots, demanding novel hybrid material systems. Companies that can develop and patent key material formulations for these next-generation platforms will secure a powerful competitive advantage in the coming decade.

- Advanced Manufacturing and Process Innovations: There is significant opportunity in developing more efficient application processes. Innovations such as inkjet printing of color filters, as opposed to traditional spin-coating and photolithography, promise to reduce material waste by up to 40% and enable more flexible, non-rectangular display designs. Furthermore, the development of photosensitive resins that require lower exposure energy can drastically reduce the energy consumption of the patterning process, aligning with the industry's broader sustainability goals and reducing the total cost of ownership for panel manufacturers.

- Strategic Vertical Integration and Co-Development: The trend towards deeper collaboration between material suppliers and panel makers is accelerating. Over 30 major co-development agreements have been signed in the past five years, focusing on creating application-specific solutions. These partnerships allow material companies to align their R&D directly with the roadmaps of their largest customers, reducing time-to-market for new products and creating "locked-in" demand. This model also helps share the immense financial risk associated with developing materials for unproven display technologies.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is primarily segmented into Color Resist Materials for LCD and Color Resist Materials for OLED. Color Resist Materials for LCD currently constitute the dominant share of the market, owing to the continued high volume production of LCD panels for televisions, monitors, and tablets. These materials are mature but constantly evolving to meet higher resolution and efficiency standards. The OLED segment, while smaller, is growing at a significantly faster pace, driven by the premium display market and requiring more specialized, high-performance formulations.

By Application:

Application segments include TVs, Monitors, Notebook and Tablet, Mobile Phones, and Others. The TVs segment is the largest consumer of color resist materials by area and volume, driven by large screen sizes and the rapid adoption of 4K and 8K resolutions. The Mobile Phones segment is a key driver of innovation, particularly for high-resolution OLED displays, and commands a premium price due to the demanding technical specifications for brightness, color accuracy, and power efficiency.

By Sales Channel:

The market is divided into Direct Channel and Distribution Channel. The Direct Channel is the predominant route to market, accounting for the vast majority of sales. This is because color resist materials are critical, high-value inputs supplied directly from chemical giants to large panel manufacturers under long-term supply agreements. The Distribution Channel serves smaller panel fabs, research institutions, and prototyping facilities.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/232753/color-resist-materials-market-2023-2031-720

Competitive Landscape:

The global Color Resist Materials market is highly concentrated and characterized by deep technological expertise and significant barriers to entry. The market is dominated by a handful of Japanese and South Korean chemical giants, with the top four players—Sumitomo Chemical, JSR Corporation, TOYO VISUAL SOLUTIONS (Toyo Ink), and FUJIFILM—collectively commanding over 75% of the global market share. Their leadership is cemented by extensive intellectual property portfolios, decades of experience in photopolymer chemistry, and entrenched relationships with the world's largest display panel producers.

List of Key Color Resist Materials Companies Profiled:

● Sumitomo Chemical (Japan)

● JSR Corporation (Japan)

● TOYO VISUAL SOLUTIONS (Toyo Ink) (Japan)

● FUJIFILM (Japan)

● Dai Nippon Printing (DNP) (Japan)

● Yoke Technology (LG Chemical) (South Korea)

● CHIMEI (Taiwan)

● Samsung SDI (South Korea)

Competitive strategy in this market revolves around relentless R&D to stay ahead of the technology curve, coupled with strategic, long-term partnerships with panel makers like LG Display, Samsung Display, BOE, and Innolux. Cost leadership and manufacturing excellence are also critical, given the intense price pressure from customers.

Regional Analysis: A Global Footprint with Distinct Leaders

● Asia-Pacific: Is the undisputed epicenter of the Color Resist Materials market, accounting for over 95% of both production and consumption. This dominance is a direct result of the region's overwhelming share of global display panel manufacturing capacity, concentrated in South Korea, Japan, Taiwan, and China. China, in particular, has become the largest consumer as its domestic panel makers have expanded aggressively, creating a massive, captive market for material suppliers.

● North America and Europe: These regions currently represent a very small fraction of the market in terms of consumption, primarily serving niche applications in military, aerospace, and medical displays. However, they are home to significant R&D activities focused on next-generation display technologies. There are also nascent efforts, supported by government initiatives, to re-shore some high-tech manufacturing, which could potentially alter the regional dynamics in the long term, though the entrenched supply chain in Asia presents a formidable challenge.

Get Full Report Here: https://www.24chemicalresearch.com/reports/232753/color-resist-materials-market-2023-2031-720

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/232753/color-resist-materials-market-2023-2031-720

Other related reports:

Sulfur Recovery Technology Market, Global Outlook and Forecast 2025-2032

Isobutyraldehyde Market, Global Outlook and Forecast 2025-2032

Polymer 3D Printing Resin Market, Global Outlook and Forecast 2025-2032

LED Materials Market, Global Outlook and Forecast 2025-2032

Flexible Epoxy Resins Market, Global Outlook and Forecast 2025-2032

Foliar Spray Market, Global Outlook and Forecast 2024-2030

Europe UHP Graphite Electrode Market Global Outlook and Forecast 2025-2032

Central Hydraulic Fluid Market, Global Outlook and Forecast 2025-2032

Global Butafosfan Market Research Report 2024(Status and Outlook)

Vinyl Wall Base Market, Global Outlook and Forecast 2025-2032

Contact us

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness