Stainless Steel Welded Pipes Market Analysis: Strategic Insights, Revenue Projections, and Global Outlook to 2030

The global Stainless Steel Welded Pipes Market is currently undergoing a robust expansion phase, driven by a convergence of infrastructure modernization and a secular shift toward high-performance, corrosion-resistant materials in the energy and chemical sectors.

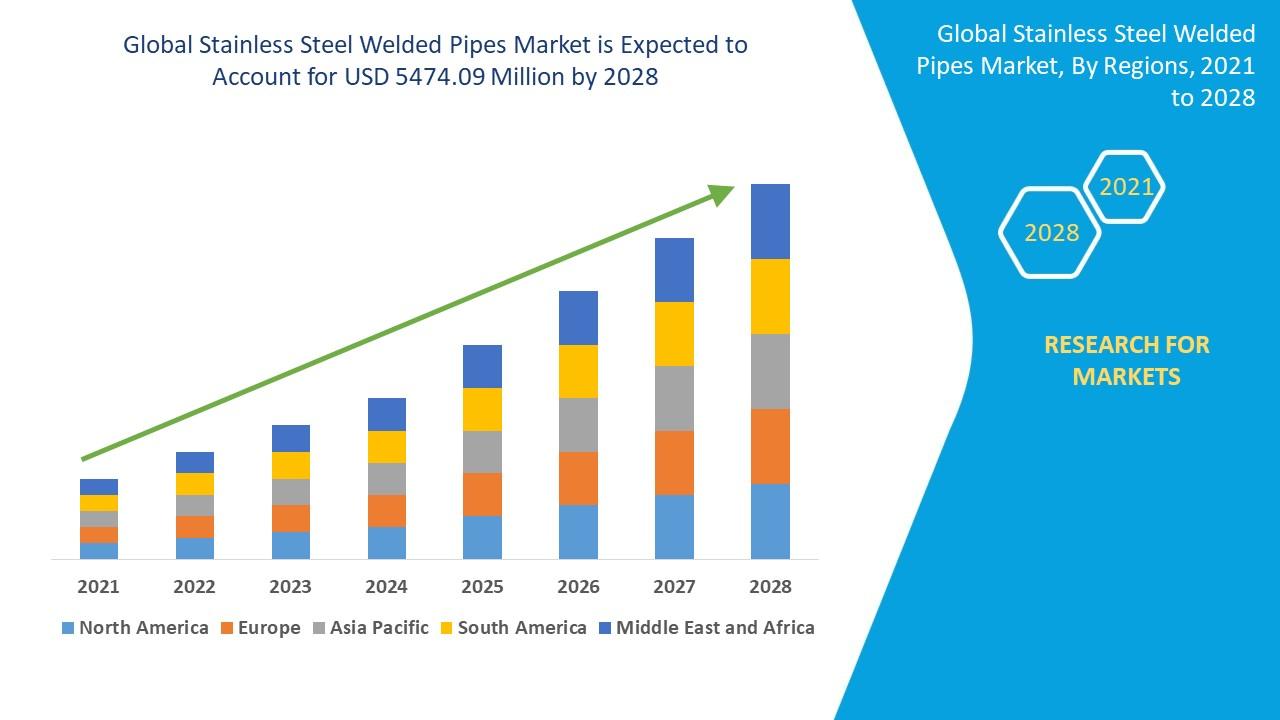

Stainless steel welded pipes market size is valued at USD 5474.09 million by 2028 is expected to grow at a compound annual growth rate of 4.50% in the forecast period of 2021 to 2028

As of late 2024, the industry has transitioned from a period of supply chain recalibration to one of aggressive capacity expansion, particularly in emerging economies. This growth is underpinned by the essential role these pipes play in transporting critical fluids under extreme temperatures and pressures, where carbon steel alternatives no longer meet stringent regulatory and safety benchmarks.

The global Stainless Steel Welded Pipes Market, currently valued at $37.15 Billion in 2024, is poised for a transformative growth phase through 2030. This valuation reflects a sophisticated ecosystem where technological precision in welding—specifically Laser and TIG (Tungsten Inert Gas) welding—has narrowed the performance gap between welded and seamless variants, offering C-level decision-makers more cost-effective revenue streams without compromising structural integrity.

Critical Market Drivers

- Accelerated Decarbonization Initiatives: The rise of the hydrogen economy requires specialized piping that can withstand hydrogen embrittlement, significantly favoring high-grade stainless steel alloys.

- Infrastructure Obsolescence and Replacement: Aging water and gas distribution networks in North America and Europe are being replaced with stainless steel to ensure a 50-year lifecycle and reduce long-term maintenance overhead.

- Desalination Plant Proliferation: To combat global water scarcity, massive investments in desalination projects—particularly in the GCC region—are driving unprecedented demand for duplex and super-duplex welded pipes.

- Automation in Manufacturing: The integration of Industry 4.0 protocols in pipe mills is optimizing production yields, reducing scrap rates by 12%, and enhancing the competitive benchmarking of top-tier manufacturers.

Market Landscape & Strategic Scope

The market landscape for welded stainless steel piping is characterized by its high barrier to entry, necessitated by the capital-intensive nature of precision welding technology and the rigorous certification requirements of the oil, gas, and nuclear industries. Unlike the broader steel sector, this niche focuses on value-added products where metallurgical purity and weld-seam integrity are the primary value propositions. The ecosystem is bifurcated between large-scale industrial providers serving the midstream energy sector and specialized boutique firms providing high-purity tubing for the pharmaceutical and semiconductor industries.

The strategic scope of the industry is currently pivoting toward "Green Steel" initiatives. Leading stakeholders are increasingly scrutinizing the carbon footprint of their primary feedstock, leading to a shift in revenue streams toward manufacturers who can provide environmental product declarations (EPDs). This shift is not merely a regulatory compliance exercise but a strategic positioning move to capture the growing "sustainable infrastructure" investment segment, which is expected to command a 15% premium over conventional products by 2030.

View company-specific share within the sector :

Stainless Steel Welded Pipes Market

Quantitative Growth Drivers and Market Velocity

The velocity of the market is best understood through its transition from the post-pandemic recovery phase to a sustained period of capital expenditure (CapEx) investment in industrial processing. The following benchmarks illustrate the trajectory of the market’s valuation:

- 2024 Global Market Valuation: Estimated at $37.15 Billion.

- Projected 2030 Market Valuation: Forecasted to reach $48.52 Billion.

- Estimated Compound Annual Growth Rate (CAGR): 4.55% through the forecast period.

- Total Revenue Upside: An incremental expansion of approximately $11.37 Billion over the next six years.

Primary Catalysts

The first catalyst is the intensification of the Global Energy Mix. While the transition to renewables is a headline trend, the immediate demand for Liquefied Natural Gas (LNG) infrastructure has created a surge in requirements for cryogenic-grade welded pipes. Stainless steel’s ability to remain ductile at -162°C is a non-negotiable requirement for the massive liquefaction and regasification terminals currently under construction in the U.S. Gulf Coast and Qatar.

Secondly, the semiconductor and high-tech manufacturing boom is creating a secondary growth tier. These facilities require ultra-high purity (UHP) stainless steel welded tubes with internally electropolished surfaces to prevent particulate contamination. As global chip manufacturing moves toward 2nm processes, the tolerance for piping impurities has reached zero, driving higher margins for manufacturers capable of meeting these extreme specifications.

Strategic Hurdles

Despite the positive outlook, the industry faces volatility in raw material pricing. Nickel, which accounts for 8% to 10% of the composition in the dominant 304 grade, has seen price fluctuations of 15% within single quarters. This volatility complicates long-term fixed-price contracts and necessitates sophisticated hedging strategies for procurement teams. Furthermore, the shortage of certified weld technicians remains a bottleneck, as the precision required for automated orbital welding exceeds the skill set of the general labor market.

Segment-Level Analysis: Demand Patterns and Opportunities

When examining the market by material grade, the 304 series remains the volume leader, capturing approximately 54% of the total market share due to its versatility and relative cost-efficiency. However, the 316 and 316L series are expected to outperform the general market CAGR, growing at a rate of 5.2%. This is attributed to their superior resistance to chloride-induced stress corrosion cracking, making them the preferred choice for marine environments and chemical processing.

From an application perspective, the Oil & Gas segment continues to dominate, representing over 55% of the total revenue. Within this segment, the demand is shifting from onshore pipelines to deep-water subsea applications where the high strength-to-weight ratio of welded stainless steel offers significant logistical advantages over heavier seamless carbon steel alternatives. The Construction and Infrastructure segment follows as the fastest-growing application, particularly in the APAC region, where urbanization is driving a 6.1% annual increase in demand for stainless steel plumbing and structural components in high-rise developments.

Competitive Intelligence and Industry Consolidation

The competitive landscape is experiencing a period of medium-to-high concentration. Top-tier players like ArcelorMittal, Nippon Steel, Baosteel, and Marcegaglia are currently engaged in a race for technological superiority and portfolio diversification. Recent trends indicate that R&D spending among the top five leaders has increased by an average of 7% year-over-year, focusing heavily on enhancing the "Weld Factor"—a metric that evaluates the efficiency and strength of the fusion zone relative to the base metal.

Strategic M&A activity is also on the rise as leaders seek to integrate vertically. By acquiring primary stainless steel melt shops, pipe manufacturers are insulating themselves from the aforementioned nickel price volatility. Furthermore, we are seeing a shift toward "Solution-as-a-Service" models, where pipe manufacturers provide not just the physical product, but also the digital monitoring systems (Smart Piping) that use embedded sensors to detect corrosion rates in real-time, creating a recurring revenue stream through maintenance and data analytics.

Regional Dynamics: Identifying High-Growth Hubs

The Asia-Pacific (APAC) region remains the powerhouse of the global industry, accounting for 60% of the total revenue share in 2023. China’s massive production capacity and domestic infrastructure spend are the primary drivers, but India is emerging as a critical growth hub with a projected CAGR of 6.4%. This is fueled by the Indian government's "Jal Jeevan Mission," which mandates the use of lead-free, corrosion-resistant piping for national water distribution.

North America and Europe are characterized by high-value, low-volume demand. In the United States, the resurgence of the domestic manufacturing sector and the "Buy American" provisions in infrastructure bills are revitalizing local pipe mills. In Europe, Germany and Italy lead the market through a focus on specialized engineering and high-purity applications, driven by the continent's stringent environmental and pharmaceutical regulations which favor the long-term sustainability profile of stainless steel.

View company-specific share within the sector :

https://www.databridgemarketresearch.com/reports/global-stainless-steel-welded-pipes-market

Future Outlook: Navigating the Path to 2030

The "Winning Strategy" for stakeholders through 2030 will involve a dual-track approach: aggressive expansion into the APAC and Middle Eastern infrastructure markets combined with a high-margin focus on specialized UHP and cryogenic products for Western markets. Decision-makers must prioritize the adoption of AI-driven quality control in the welding process to minimize rework costs and ensure compliance with evolving global safety standards.

In conclusion, the industry is entering a "Golden Age" of material science where the historical limitations of welded joints have been effectively engineered out of the equation. This technical parity, combined with favorable macroeconomic tailwinds in the energy and water sectors, ensures that the Stainless Steel Welded Pipes Market will remain a cornerstone of global industrial advancement through the next decade.

Browse More Reports:

Global Hybrid Imaging Market

Global Indirect Debris Removal Market

Global Integrated Labelling System Market

Global Low Emission Vehicles Market

Global Metal Carboxylate Market

Global Microcontroller for Parking Assist System Market

Global Micro-Perforated Food Packaging Market

Global Mortuary Equipment Market

Global Non-volatile Memory Express Market

Global Obesity Treatment Market

Global Ophthalmic Packaging Market

Global Organic Asphalt Modifiers Market

Global Printed Tape Market

Global Propionic Acid for Animal Feed Market

Global Rear Electric Axle (E-Axle) Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

FAQ: Strategic Market Insights

What is the projected CAGR for the Stainless Steel Welded Pipes Market through 2030?

The market is expected to expand at a compound annual growth rate (CAGR) of approximately 4.55% between 2024 and 2030. This steady growth is supported by a significant increase in industrial CapEx and a global push for more durable, low-maintenance infrastructure materials that can replace traditional carbon steel.

Which grade of stainless steel is currently dominating the welded pipe sector?

The 304 grade remains the dominant material due to its balance of cost and corrosion resistance, accounting for over half of the global volume. However, the 316L grade is seeing the fastest adoption in high-growth niches like pharmaceutical manufacturing and marine engineering due to its enhanced molybdenum content and superior pitting resistance.

How is the hydrogen economy impacting demand for stainless steel welded pipes?

The shift toward hydrogen energy is a massive growth catalyst as hydrogen molecules can permeate and weaken standard carbon steel pipes. Stainless steel, particularly high-nickel austenitic grades, provides the necessary barrier and structural stability required for the safe transport and storage of hydrogen at high pressures.

Which region offers the most significant investment opportunity for pipe manufacturers?

Asia-Pacific is the most significant region for both production and consumption, led by China and India. While China provides the greatest volume, India is currently identified as the highest-growth opportunity for new market entrants due to its massive national water and energy infrastructure projects scheduled through the end of the decade.

What are the primary risks associated with the Stainless Steel Welded Pipes Market?

The most significant risks include the extreme volatility of raw material prices, specifically nickel and chromium, which can disrupt profit margins. Additionally, the industry faces pressure from the rising costs of energy used in the manufacturing process and a widening gap in the availability of highly skilled specialized welding labor.

Why is the "welded" segment growing in comparison to the "seamless" segment?

The welded segment is gaining ground because modern welding technologies like laser and plasma arc welding have improved seam integrity to the point where they can match the pressure ratings of seamless pipes in many applications. Since welded pipes are generally more cost-effective to produce, they offer a superior ROI for large-scale infrastructure projects.

Given the current trajectory of the industrial sector, the Stainless Steel Welded Pipes Market stands as a high-value opportunity for institutional investors and industrial stakeholders aiming for long-term growth.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness