What’s Fueling Digital Transformation in the Insurance Sector via Digital Insurance Platforms?

"What’s Fueling Executive Summary Digital Insurance Platform Market Size and Share Growth

CAGR Value

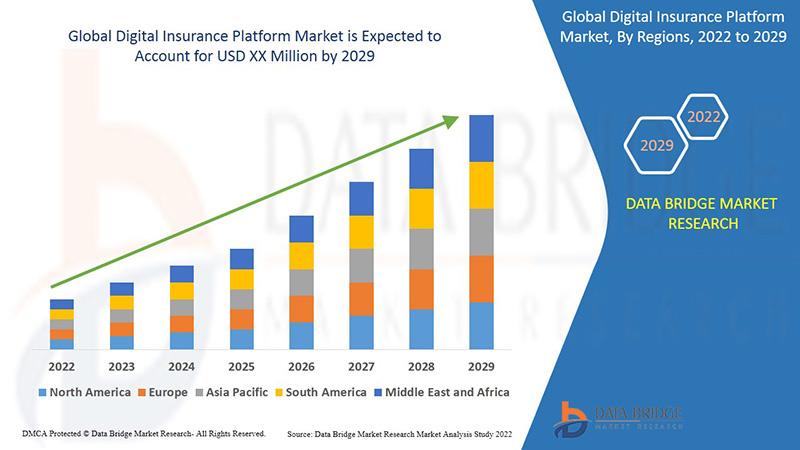

Data Bridge Market Research analyses that the digital insurance platform market will exhibit a CAGR of 13.7% for the forecast period of 2022-2029.

An influential Digital Insurance Platform Market document supports in achieving a sustainable growth in the market, by providing a well-versed, specific and most relevant product and market information. This report provides details about historic data, present market trends, future product environment, Market strategies, technological innovation, upcoming technologies, emerging trends or opportunities, and the technical progress in the related industry. Digital Insurance Platform Market report also takes into account strategic profiling of the major players in the market, all-inclusive analysis of their basic competencies, and hence keeps competitive landscape of the market in front of the client.

The steadfast Digital Insurance Platform Market research report underlines an insightful overview of product specification, technology, applications, product type and production analysis considering major factors such as revenue, cost, and gross margin. The report is a useful resource which provides present as well as upcoming technical and financial details of the industry to 2030. The market drivers and restraints have been examined using SWOT analysis. To provide clients with the best in the industry, a team of experts, skilled analysts, dynamic forecasters and knowledgeable researchers work meticulously while preparing Digital Insurance Platform Market business report.

Navigate the evolving landscape of the Digital Insurance Platform Market with our full analysis. Get your report:

https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market

Digital Insurance Platform Market Outlook & Forecast

Segments

- By Component

- Solution

- Services

- By Deployment Type

- On-Premises

- Cloud

- By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

- By End-User

- Insurance Companies

- Third-Party Administrators

- Brokers

The global digital insurance platform market is segmented based on components, deployment type, organization size, and end-users. In terms of components, the market is divided into solutions and services. Solutions include various software offerings that cater to the digital insurance needs, while services encompass the support and maintenance required for the proper functioning of these platforms. When it comes to deployment type, businesses can opt for on-premises solutions or cloud-based services, depending on their specific requirements and IT infrastructure. Organization size further segments the market into large enterprises and small to medium-sized enterprises (SMEs), showcasing that digital insurance platforms cater to a diverse range of businesses. Lastly, the end-users of digital insurance platforms include insurance companies themselves, third-party administrators, and brokers, each having unique needs and functionalities within the platform.

Market Players

- IBM

- Microsoft

- SAP SE

- Oracle

- Infosys Limited

- DXC Technology

- Pegasystems Inc.

- Majesco

- Cognizant

- Amazon Web Services

- Microsoft Corporation

Several key players dominate the global digital insurance platform market, providing a wide range of solutions and services to cater to the increasing digitalization of the insurance industry. Companies such as IBM, Microsoft, SAP SE, and Oracle offer robust digital insurance platforms with advanced features and functionalities to streamline operations and enhance customer experience. Additionally, consulting and IT services companies like Infosys Limited, DXC Technology, and Cognizant play a crucial role in the implementation and customization of digital insurance platforms for clients. Furthermore, cloud service providers such as Amazon Web Services and Microsoft Corporation offer secure and scalable hosting solutions for digital insurance platforms, ensuring efficient performance and data management.

The global digital insurance platform market is witnessing significant growth propelled by the increasing adoption of digital technologies across the insurance sector. One key trend shaping the market is the rising demand for advanced solutions that can automate processes, enhance customer engagement, and improve operational efficiency. Companies are looking to digital insurance platforms to streamline policy management, claims processing, underwriting, and customer service, thereby driving the need for robust solutions and services in the market. Additionally, the shift towards cloud-based deployment models is gaining traction as organizations seek flexibility, scalability, and cost-effectiveness in managing their digital insurance platforms.

Moreover, the market is characterized by intense competition among key players vying for market share and leadership in the digital insurance platform space. Companies such as IBM, Microsoft, SAP SE, and Oracle are focusing on continuous innovation to introduce new features and functionalities that align with the evolving needs of insurance companies and other end-users. These market players are investing heavily in research and development to stay ahead of the curve and address the complex challenges faced by the insurance industry in the digital age. Partnerships, collaborations, and acquisitions are also becoming common strategies among players to expand their product portfolios and reach a wider customer base.

Furthermore, with the increasing digitization of the insurance sector, there is a growing emphasis on data security and privacy within digital insurance platforms. Market players are investing in cybersecurity measures to ensure that sensitive customer information is protected from cyber threats and breaches. Compliance with regulatory standards and industry guidelines is paramount for companies operating in the digital insurance platform market to build trust with customers and demonstrate reliability in safeguarding data assets.

Additionally, the market is witnessing a surge in demand for personalized and customized digital insurance solutions tailored to specific business needs. Large enterprises and SMEs are seeking platforms that offer flexibility, scalability, and seamless integration with existing systems to drive digital transformation initiatives effectively. End-users such as insurance companies, third-party administrators, and brokers are increasingly looking for feature-rich platforms that can help them stay competitive in a rapidly evolving industry landscape.

Overall, the global digital insurance platform market is poised for continued growth as businesses across the insurance sector recognize the importance of digitalization in driving efficiency, innovation, and customer-centricity. As technology continues to advance and disrupt traditional insurance operations, the market is expected to witness further evolution with new players entering the domain and existing ones enhancing their offerings to meet the changing demands of the digital era.The global digital insurance platform market is experiencing a transformative period driven by the escalating adoption of digital technologies within the insurance industry. Key players in this market are leveraging innovations to introduce advanced solutions that automate processes, enhance customer engagement, and boost operational efficiency. With the demand for streamlined policy management, claims processing, underwriting, and customer service on the rise, companies are increasingly turning to digital insurance platforms to meet these needs effectively. The trend towards cloud-based deployment models is gaining momentum as organizations seek flexibility, scalability, and cost-effectiveness in managing their digital insurance platforms. This shift indicates a broader industry trend towards embracing cloud technology for enhanced performance and data management capabilities.

As competition intensifies among market players, continuous innovation has become imperative to stay ahead of the curve in the digital insurance platform space. Leading companies such as IBM, Microsoft, SAP SE, and Oracle are investing significantly in research and development to address the evolving requirements of insurance companies and end-users. Moreover, collaborations, partnerships, and acquisitions are becoming prevalent strategies among players to expand their product offerings and reach a broader customer base. The focus on enhancing features and functionalities to meet the complex challenges faced by the insurance industry in the digital age underscores the commitment of market players to drive innovation and deliver value-added solutions to their clients.

Data security and privacy are paramount concerns within the digital insurance platform market, with market players investing heavily in cybersecurity measures to safeguard sensitive customer information from cyber threats and breaches. Compliance with regulatory standards and industry guidelines is essential to build trust with customers and demonstrate a commitment to protecting data assets. The emphasis on data security underscores the critical importance of maintaining customer trust and confidence in the digital insurance ecosystem.

Furthermore, the market is witnessing a surge in demand for personalized and tailored digital insurance solutions that cater to specific business needs. Businesses, both large enterprises, and SMEs are increasingly seeking flexible, scalable, and integrated platforms to drive effective digital transformation initiatives. End-users such as insurance companies, third-party administrators, and brokers are looking for feature-rich platforms that can help them enhance their competitiveness in a rapidly evolving industry landscape. This demand for customized solutions underscores the growing recognition of the pivotal role that digital insurance platforms play in enabling operational efficiency, innovation, and customer-centricity across the insurance sector.

In conclusion, the global digital insurance platform market is poised for sustained growth as companies recognize the transformative power of digitalization in driving business success. With the continuous evolution of technology and the changing landscape of the insurance industry, market players are expected to continue innovating and adapting to meet the evolving needs of their clients effectively. The ongoing convergence of digital technologies and insurance services will likely pave the way for new opportunities, challenges, and advancements in the digital insurance platform market.

Inspect the market share figures by company

https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market/companies

Digital Insurance Platform Market Research Questions: Country, Growth, and Competitor Insights

- What is the full scope of the Digital Insurance Platform Market valuation?

- What is the average growth rate expected post-2025?

- What segmentation variables are most impactful?

- Which firms lead in sustainability within the Digital Insurance Platform Market?

- What product categories are showing exponential growth?

- Which countries are expanding their consumer base?

- What is the most rapidly developing regional economy?

- Which nations have the highest investment inflow?

- What region is setting pricing benchmarks?

- What are the innovation challenges facing this Digital Insurance Platform Market industry?

Browse More Reports:

Global Encapsulated Calcium Propionate Market

Global Floating Nuclear Power Plant EPC Market

Global Gastrointestinal Diseases Drug Development Market

Global Gummy Worms Market

Global Insoluble Dietary Fiber Market

Global Intranet Software Market

Global Intravenous Nucleic Acid Therapeutics Market

Global Kickboxing Equipment Market

Global Luxury Candle Market

Global Medical Nonwoven Market

Global Non-PVC IV Bags Market

Global Offshore Legal Processing Market

Global Personal Gadget Insurance Market

Global Pontine Glioma Treatment Market

Global Robotic Gripper Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness