Pet Insurance Market Research Report: Growth, Share, Value, Size, and Analysis By 2032

Detailed Analysis of Executive Summary Pet Insurance Market Size and Share

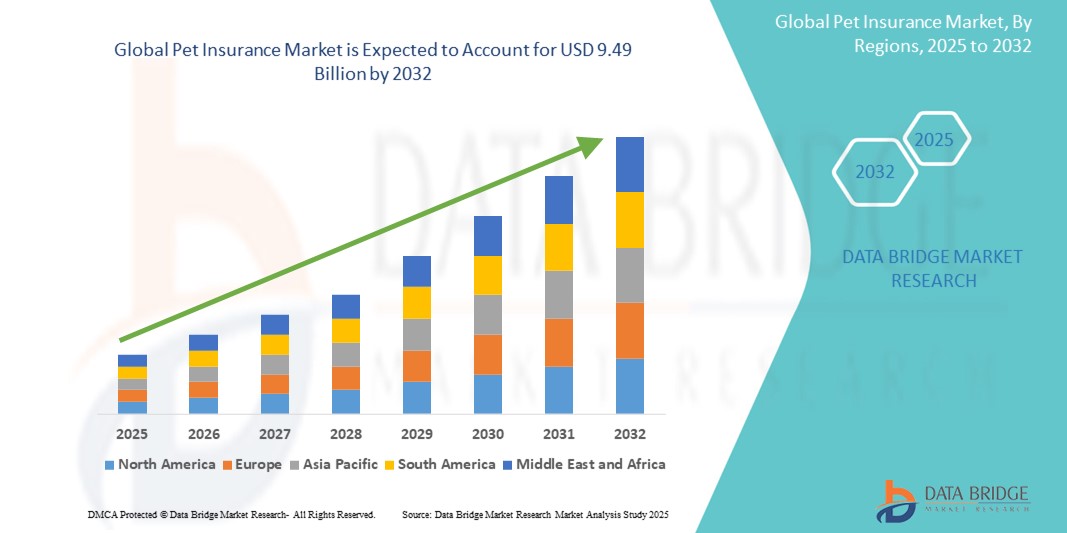

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period.

- The market growth is largely fueled by the increasing pet adoption rates and heightened awareness among pet owners regarding the rising costs of veterinary care, prompting a greater need for financial protection and comprehensive pet health coverage.

When market research report is brilliant and precise, it proves to be a backbone for the business that helps to thrive in the competition. An all-inclusive Pet Insurance Market report gives an utter background analysis of the Pet Insurance Market industry along with an assessment of the parental market. It endows with a telescopic view of the competitive landscape with which planning of the strategies becomes convenient. Strategic planning supports in improving and enhancing the products with respect to customer’s preferences and inclinations. Moreover, Pet Insurance Market document also describes exhaustive overview about product specification, product type, technology, and production analysis by taking into account other major factors such as revenue, cost, gross and gross margin.

The dependable Pet Insurance Market report is a vital source of information which gives current and approaching technical and financial details of the industry to 2030. The report displays the systematic investigation of current scenario of the market, which covers several market dynamics. The report also recognizes and analyses the growing trends along with major drivers, restraints, challenges and opportunities in the Pet Insurance Market industry. The vigilant efforts accompanied with integrated approaches and sophisticated techniques results into an excellent market research report that drives the decision making process of the business. In no doubt, businesses will increase sustainability and profitability with Pet Insurance Market research report.

Take a deep dive into the current and future state of the Pet Insurance Market. Access the report:

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market

Pet Insurance Market Data Summary

Segments

- Type: The global pet insurance market can be segmented into lifetime cover, non-lifetime cover, accident-only, and others. Lifetime cover insurance plans provide coverage for the pet's entire life, while non-lifetime covers limit the coverage period for each condition. Accident-only plans cover only injuries resulting from accidents.

- Animal Type: Dogs, cats, and others are the key segments in the pet insurance market based on the animal type. The majority of pet insurance policies are for dogs and cats, with specialized coverage tailored to their specific healthcare needs.

- Sales Channel: The market can also be segmented based on sales channels such as brokers, agency, and online. With the increasing adoption of digital platforms, online sales channels are gaining popularity in the pet insurance market as they offer convenience and transparency to consumers.

Market Players

- Petplan Limited: A pioneer in the pet insurance industry, Petplan Limited offers comprehensive coverage for pets, including illness, accidents, and hereditary conditions.

- Trupanion: Known for its direct payment option to veterinarians, Trupanion simplifies the reimbursement process for pet owners and provides quick access to funds during emergencies.

- Nationwide Mutual Insurance Company: With a wide range of pet insurance plans, Nationwide Mutual Insurance Company offers customizable coverage options to suit different budgets and pet healthcare needs.

- Healthy Paws Pet Insurance, LLC: Focused on providing straightforward and affordable pet insurance plans, Healthy Paws Pet Insurance, LLC has gained popularity for its quick claim processing and high customer satisfaction rates.

For more insights on the global pet insurance market, visit .The global pet insurance market is experiencing significant growth driven by several key factors. One such factor is the increasing awareness among pet owners about the benefits of pet insurance in managing the rising costs of veterinary care. As more pet owners consider their pets as integral members of their families, the demand for comprehensive and specialized insurance coverage continues to rise. This trend is further fueled by the growing incidence of accidents, illnesses, and hereditary conditions in pets, prompting owners to seek financial protection through insurance plans.

Another driver of growth in the pet insurance market is the expanding range of coverage options offered by insurance providers. In a bid to cater to diverse consumer needs and preferences, market players are introducing innovative insurance products with customizable features. These include coverage for alternative therapies, behavioral therapy, dental care, and even coverage for travel-related risks. Such flexibility in policy offerings not only enhances the value proposition for pet owners but also contributes to the overall market growth by attracting new customers.

Moreover, the advancement in technology has revolutionized the way pet insurance is marketed, sold, and serviced. Online sales channels have emerged as a preferred choice for many consumers due to their convenience, accessibility, and real-time policy management options. Insurance providers leveraging digital platforms for customer acquisition and retention are likely to gain a competitive edge in the market. Additionally, the integration of technologies like artificial intelligence and data analytics is enhancing underwriting processes, claims management, and customer experience, driving efficiencies and improving overall market dynamics.

Furthermore, the evolving regulatory landscape in the pet insurance industry is shaping market trends and dynamics. Regulatory bodies are increasingly focusing on consumer protection, standardization of policy terms, and transparency in pricing to ensure fair practices in the industry. Compliance with these regulations is not only imperative for insurance providers to operate legally but also to build trust and credibility among consumers. As the regulatory environment continues to evolve, market players need to stay agile and proactive in adapting their strategies to remain competitive and compliant.

In conclusion, the global pet insurance market presents lucrative opportunities for growth and innovation driven by factors such as increasing pet ownership, rising healthcare costs, technological advancements, and regulatory developments. To capitalize on these opportunities, insurance providers need to focus on product differentiation, customer-centric strategies, digital transformation, and regulatory compliance. By aligning their business strategies with these market trends, players in the pet insurance industry can foster sustainable growth, strengthen customer relationships, and establish a competitive advantage in this dynamic market landscape. The global pet insurance market is witnessing a shift towards more comprehensive and specialized coverage options, driven by the increasing awareness among pet owners about the benefits of insuring their furry companions. As pet owners consider their pets as family members, the demand for insurance plans that provide coverage for accidents, illnesses, and hereditary conditions is on the rise. This trend is not only influenced by the emotional attachment people have with their pets but also by the escalating costs of veterinary care, making insurance a prudent financial choice for many. By offering tailored coverage options, insurance providers can cater to the diverse needs of pet owners, enhancing the value proposition and driving market growth.

Innovative product offerings are also shaping the pet insurance landscape, with companies introducing customizable features and additional coverage options such as alternative therapies, dental care, and travel-related risks. This flexibility in policy design not only meets the evolving expectations of consumers but also attracts new customers to the market. Furthermore, the integration of technology in the insurance sector is revolutionizing how policies are marketed, sold, and managed. Online sales channels are gaining popularity due to their convenience and accessibility, enabling insurers to reach a wider consumer base and provide real-time policy management options. By leveraging technologies like artificial intelligence and data analytics, insurance providers can streamline processes, enhance customer experience, and gain a competitive edge in the market.

Regulatory developments are also influencing market dynamics in the pet insurance industry, with regulatory bodies emphasizing consumer protection, standardization of policy terms, and transparency in pricing. Compliance with these regulations is essential for building trust and credibility among consumers, highlighting the importance of ethical practices and fair policies in the market. As regulations continue to evolve, insurance providers must stay abreast of the changes and adapt their strategies to ensure compliance while remaining competitive in the market.

Overall, the pet insurance market presents abundant opportunities for growth and innovation, with factors such as increasing pet ownership, rising healthcare costs, technological advancements, and regulatory changes driving market dynamics. By focusing on product differentiation, customer-centric strategies, digital transformation, and regulatory compliance, insurance providers can position themselves for success in this dynamic and evolving market landscape.

Investigate the company’s industry share in depth

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market/companies

Pet Insurance Market Overview: Strategic Questions for Analysis

- What is the reported market size of the Pet Insurance Market currently?

- What rate of expansion is anticipated for the Pet Insurance Market?

- What segmentations provide the framework of the Pet Insurance Market?

- Who are considered the top competitors in this Pet Insurance Market?

- What are the latest strategic product moves?

- Which national markets are included in the Pet Insurance Market research?

- What is the fastest expanding area within the global Pet Insurance Market landscape?

- Which country might outpace others in Pet Insurance Market capture?

- What region has the biggest stake in the Pet Insurance Market today?

- Which country is projected to lead in CAGR?

Browse More Reports:

North America Machined seals Market

Asia-Pacific Medical Foods for Inborn Errors of Metabolism Market

Middle East and Africa Medical Foods for Inborn Errors of Metabolism Market

North America Medical Foods for Inborn Errors of Metabolism Market

Argentina Menopause Drugs Market

Chile Menopause Drugs Market

North America Modular Data Center Market

North America Nuclear Imaging Devices Market

Europe Nuclear Imaging Devices Market

Asia-Pacific Nuclear Imaging Devices Market

Asia-Pacific Nut Processing Equipment Market

Europe Nut Processing Equipment Market

Middle East and Africa Nut Processing Equipment Market

North America Nut Processing Equipment Market

Europe Octabin Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness