UK Enterprise Asset Management Market Size, Industry Growth | 2035

The fundamental economic value of optimizing the entire lifecycle of an organization's physical assets is meticulously quantified within the UK Enterprise Asset Management Market Valuation. This valuation is a comprehensive financial measure of the total annual expenditure by UK-based organizations on the software, services, and associated technologies required to manage their capital-intensive assets, from initial procurement to final decommissioning. It is a composite figure, aggregating revenues from a diverse range of components. This includes perpetual license fees and maintenance contracts for traditional on-premise EAM systems, which are often deeply embedded in an organization's operational core. However, the largest and most rapidly growing component of the valuation is derived from recurring subscription fees for cloud-based Software-as-a-Service (SaaS) EAM platforms. Furthermore, a substantial portion of the valuation is derived from the professional services sector, encompassing strategic asset management consulting, solution implementation and integration with other enterprise systems like ERP and SCM, user training, and ongoing managed support. The market's robust financial worth is directly correlated to the critical business outcomes these systems deliver, including increased asset uptime and reliability, reduced maintenance costs, extended asset lifespan, and improved safety and regulatory compliance. The UK Enterprise Asset Management Market is expected to reach USD 800 Million by 2035, growing at a CAGR of 4.365% during the forecast period 2025-2035. This substantial projection underscores the strategic consensus that effective asset management is not an operational afterthought but a core driver of productivity, profitability, and resilience for the UK's asset-intensive industries.

A granular deconstruction of the market's valuation reveals its deep penetration across the UK's most critical infrastructure and industrial sectors. The utilities sector, encompassing water, gas, and electricity generation and distribution, represents a cornerstone of the market's valuation. These organizations manage vast and aging networks of assets (pipes, cables, transformers) and are driven to invest in EAM by the need to ensure service reliability, meet stringent regulatory requirements from bodies like Ofgem and Ofwat, and optimize their capital investment plans. The public sector, particularly in transport and infrastructure, is another massive contributor. This includes the management of the UK's rail network, its strategic road network (motorways and A-roads), and the assets of major airports and ports. The valuation is also heavily bolstered by the UK's manufacturing sector, from automotive to food and beverage, where EAM is critical for managing production line equipment and ensuring maximum uptime. Other significant contributors include the oil and gas sector (for managing offshore and onshore assets), the property and facilities management industry (for maintaining large commercial and residential property portfolios), and the fleet management sub-segment, which is a major component across all these industries. This deep entrenchment in the UK's foundational industries provides a resilient and diversified base for the market's impressive financial standing.

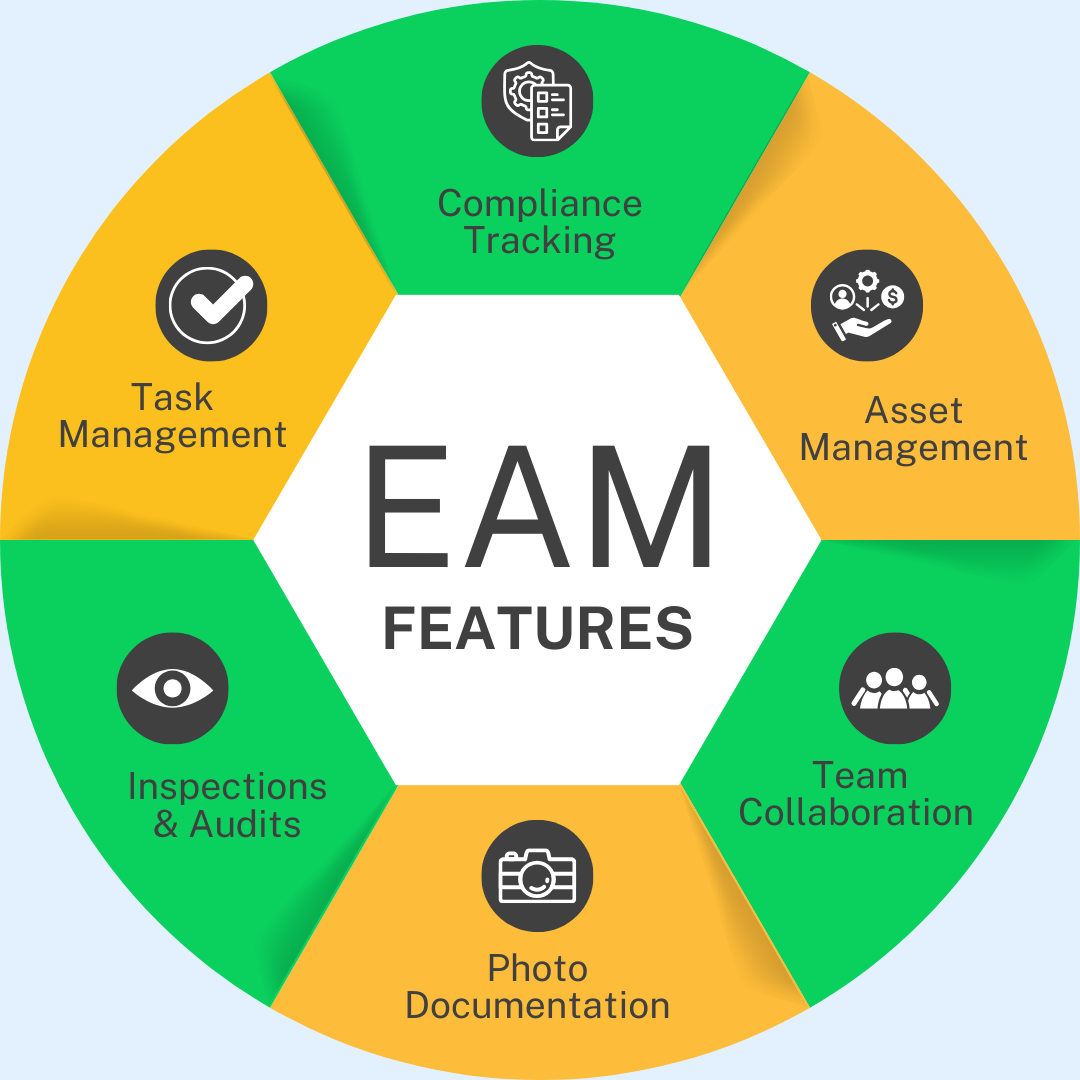

Looking ahead, the market's valuation is poised for significant expansion, driven by the increasing sophistication of the underlying technology and the evolution towards a more predictive and intelligent approach to asset management. The valuation will be increasingly inflated by the infusion of next-generation technologies like the Internet of Things (IoT), artificial intelligence (AI), and digital twins. Premium pricing is being commanded by EAM platforms that can ingest real-time condition data from IoT sensors on assets and then use AI and machine learning algorithms to perform "predictive maintenance" (PdM), forecasting a potential failure before it occurs. The rise of "digital twins"—virtual, real-time replicas of physical assets—is creating a new, high-value segment of the market, allowing for advanced simulation and "what-if" analysis. Furthermore, the market is expanding to include more sophisticated mobile EAM capabilities, empowering field technicians with all the information they need on a ruggedized tablet or smartphone. The convergence of EAM with geospatial (GIS) and building information modeling (BIM) data is another key factor, creating a richer, more contextualized view of an organization's assets and driving the valuation higher.

Top Trending Reports -

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness