The Future of Peanuts Industry: Sustainability, Product Innovation, and Market Forecast to 2030

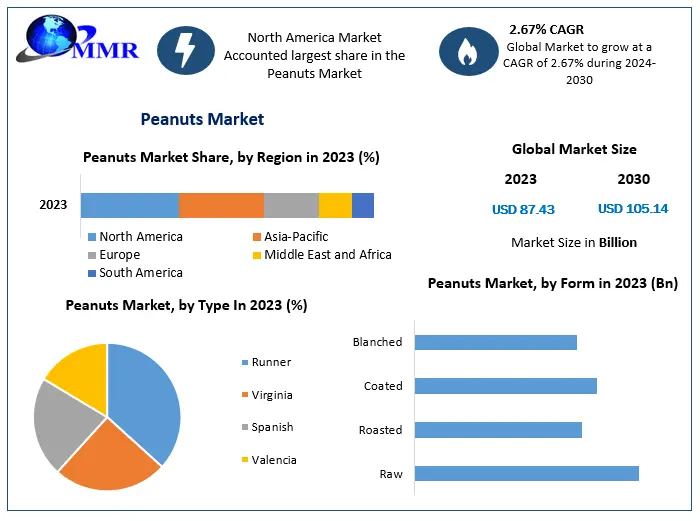

The Peanuts Industry, already substantial, is set to expand further in coming years, driven by rising demand for nutrient‑rich snacks and plant‑based protein sources. According to recent research, the market which stood at USD 87.43 billion in 2023, is forecast to reach approximately USD 105.14 billion by 2030, growing at a compound annual growth rate (CAGR) of about 2.67% during the period 2024‑2030.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/221218/

Market Estimation & Definition

The peanuts market comprises all forms and applications of peanuts — raw, processed, flavored, snack forms, spreads, oil, and others — across multiple regions globally. Peanuts are valued not only for their taste and culinary versatility but also for their nutritional properties: they are a rich source of proteins, healthy fats (monounsaturated and polyunsaturated), dietary fiber, essential minerals such as potassium, phosphorus, magnesium, and B‑vitamins, with relatively low carbohydrates and saturated fat.

“Peanuts” in this market include varieties such as Runner, Virginia, Spanish, and Valencia; forms such as raw, roasted, coated, blanched, powder, etc.; and applications spanning direct consumption, culinary use, bakery and confectionery, peanut butter and spreads, peanut bars, dairy products, oil production, and others. Distribution channels include hypermarkets/supermarkets, convenience stores, specialty stores, e‑commerce, among others.

In 2023, market value was USD 87.43 Billion. By 2030, projected valuation is USD 105.14 Billion under current trends, reflecting a CAGR of 2.67%.

Market Growth Drivers & Opportunities

a) Increasing demand for nutrient‑rich snacks & plant‑based protein

Consumers worldwide are increasingly health conscious. Peanuts are prominent in the trend towards plant‑based proteins, both in developed markets (e.g., USA, Canada, Europe) and emerging economies (e.g., China, India). Snacking habits are shifting to healthier, more functional choices.

b) Versatility in applications

Peanuts are used across many product categories: from peanut butter and spreads to bakery, confectionery, peanut oil, bars and more. Innovations in flavor, coatings, and fortified forms (e.g., high protein, low sugar) represent opportunities.

c) Product innovation and diversification

Flavored peanuts, coated/sweet/savory styles, peanut-based energy bars, powders, peanut extracts are growing in popularity. There's also demand for convenience (snacks, bars) and premium gourmet uses (e.g., Virginia peanuts, flavor variations).

d) Growing disposable incomes & dietary shifts in emerging markets

In Asia Pacific especially, increasing incomes and urbanization lead to greater consumption of processed and convenient snack foods. Growth in plant-based diets in India and China is favoring peanuts.

e) Regulatory & awareness trends

Emerging awareness of nutritional benefits, government policies supporting agriculture, trade policies, and influences of sustainability and environmental concerns also shape demand.

f) Challenges & risk factors

Weather and climate variation can impact yields; agricultural policies, costs of inputs, trade barriers, and supply chain issues (storage, transportation) continue to be restraints. Concerns over aflatoxin contamination and food safety in peanuts also influence regulation and consumer perception.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/221218/

Segmentation Analysis

The segmentation of the peanuts market can be described across several dimensions, revealing which portions are growing, which have premium potential, and how consumer preferences are changing.

a) By Type (Varietal Segments)

-

Runner peanuts: Known for uniform size, preferred for peanut butter production due to their consistency.

-

Virginia peanuts: Larger kernels, distinguished flavor, often used in gourmet snacks or roasted whole.

-

Spanish peanuts: Smaller, strong flavor, often roasted or used in coated/snack formats.

-

Valencia peanuts: Sweet, smaller nuts, often used in confectionery or direct consumption.

Each variety attracts different consumer segments. Gourmet snack buyers may favor Virginia; confectionery companies may prefer Valencia or Spanish; industrial peanut-butter producers often prefer Runner types.

b) By Form

-

Raw: Unprocessed, for further processing or roasting, culinary use.

-

Roasted: Enhanced flavor; roasted peanuts are among the more popular snacking forms.

-

Coated: Includes chocolate, sugar, spices etc., appealing to indulgent or novelty snack markets.

-

Blanched: Skin removed, used in confectionery or where visual/palatability factors matter.

-

Powder: Peanut flour/powder for use in shakes, protein foods, baking, or health foods.

-

Others: Peanut extracts, specialty forms.

c) By Application

-

Direct Consumption / Culinary Purpose: Whole roasted or raw peanuts, snacks, cooking.

-

Bakery and Confectionery: Peanut inclusion in cookies, cakes, sweets.

-

Peanut Butter & Spreads: Major segment, especially in Americas, increasingly in Europe and Asia.

-

Peanut Bars: On-the-go nutritious snack bars using peanuts.

-

Dairy Products: Peanut inclusion in yogurts, health shakes, etc.

-

Oil Production: Peanut oil used in cooking, food processing.

-

Others: Sauces, dressings, niche uses.

d) By Distribution Channel

-

Hypermarkets & Supermarkets: Traditional large retailers remain a dominant distribution mode for many peanut products.

-

Convenience Stores: For snacking, impulse purchases.

-

Specialty Stores: Health food stores, gourmet shops, natural/organic food stores.

-

E-commerce: Growing fast, especially for niche, premium, natural, or specialty peanut forms/spreads.

-

Others: Food service, institutional buyers.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/221218/

Country-Level Analysis: United States & Germany

United States

-

The U.S. is a major producer and consumer of peanuts, especially in Alabama, Texas, Virginia, Oklahoma, Florida, and North Carolina. Peanut butter consumption, snack forms, and growing interest in plant-based protein drive the market.

-

Health trends, e-commerce penetration, and innovation in peanut products (bars, flavored coatings) are significant drivers.

-

Regulatory frameworks (USDA, food safety) ensure quality and support exports.

Germany

-

Germany is a leading European market for processed and consumer-oriented peanuts. Health-conscious snacking, vegan/flexitarian trends, and premium natural food demand drive growth.

-

The food processing industry demands raw peanuts for ingredients, spreads, confections, and other processed foods.

-

Flavored, roasted, and premium peanuts, organic certification, and functional benefits are increasingly popular. Seasonal consumption in bakery and confectionery also boosts demand.

Key Players of the Peanuts Market

1. Olam International (Singapore)

2. Kraft Foods Inc. (United States)

3. Hampton Farms Inc (United States)

4. Star Snacks Co. LLC (United States)

5. Wilco Peanut Company (United States)

6. ADM - Archer Daniels Midland Company (United States)

7. Cargill, Incorporated (United States)

8. Adani Wilmar (India)

9. Hormel Foods, LLC (United States)

10. John B. Sanfilippo & Son, Inc. (United States)

11. Whitley's Peanut Factory (United States)

12. Frito-Lay North America, Inc. (PepsiCo) (United States)

13. The Peanut Shop of Williamsburg (United States)

14. Haldiram's India Pvt Ltd (India)

15. Margaret Holmes (United States)

Conclusion

The global peanuts market is on a steady growth path, driven by rising demand for plant-based proteins, health-conscious snacking, and opportunities in emerging markets. Challenges include climate, food safety, and supply chain issues, but companies innovating with quality, flavor, and convenience are well-positioned.

The U.S. remains a major production and consumption hub, while Germany exemplifies European demand for premium, healthy, functional peanut-based foods. Leading players, alongside nimble regional companies, will benefit from product diversification, distribution expansion, and sustainability initiatives.

About Us- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness