2.80% CAGR Forecast for Laser Material Industry Through 2034

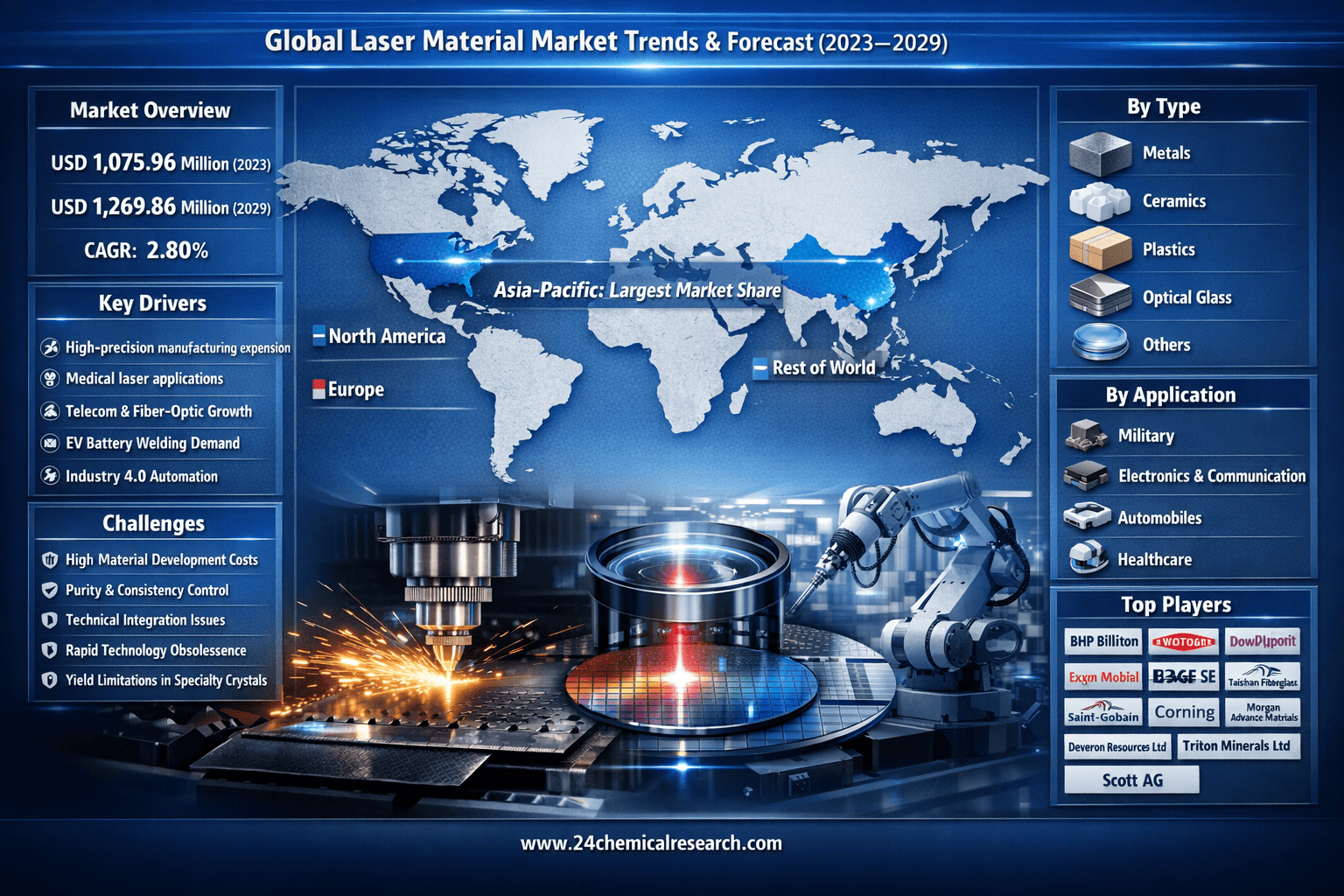

According to 24Chemical Research, Global Laser Material Market was estimated at USD 1075.96 million in 2023 and is projected to reach USD 1269.86 million by 2029, exhibiting a CAGR of 2.80% during the forecast period.

Laser technology, a revolutionary innovation that has transformed industries from manufacturing to medicine, relies on a sophisticated ecosystem of advanced materials to function effectively. These materials – encompassing precisely engineered metals, high-purity ceramics, specialized plastics, and optical-grade glass – form the very foundation of laser systems. They are integral to every component, from the diodes that generate the initial light to the complex optics that focus and direct the beam. The performance, efficiency, and longevity of a laser are intrinsically tied to the quality and properties of these materials. As applications for lasers expand into new frontiers like autonomous vehicles, next-generation communication networks, and advanced surgical procedures, the demand for materials that can handle higher power outputs, extreme environments, and unprecedented precision continues to surge, driving continuous innovation and strategic developments within the global market.

Get Full Report Here: https://www.24chemicalresearch.com/reports/264130/global-laser-material-market-2024-161

Market Dynamics:

The market's trajectory is shaped by a complex interplay of powerful growth drivers, significant restraints that are being actively addressed, and vast, untapped opportunities.

Powerful Market Drivers Propelling Expansion

-

Proliferation in High-Precision Manufacturing: The manufacturing sector's relentless pursuit of precision and efficiency is a primary catalyst for laser material demand. Laser cutting, welding, and etching have become indispensable in automotive and aerospace production, where they enable the fabrication of complex components with micron-level accuracy. The global automotive industry, a colossal sector valued at over $2.8 trillion, increasingly relies on laser-welded lightweight alloys to improve fuel efficiency and safety. Similarly, the burgeoning electric vehicle market demands high-precision battery welding and component manufacturing, applications where laser technology is unmatched. This industrial shift towards automation and precision manufacturing is creating sustained, high-volume demand for robust and reliable laser materials.

-

Breakthroughs in Medical and Healthcare Applications: The medical field is undergoing a transformation fueled by laser technology, necessitating advanced biocompatible and high-purity materials. Lasers are now routinely used in a vast array of procedures, from minimally invasive surgeries and ophthalmology (like LASIK) to advanced dermatology and dental care. The precision of laser surgery minimizes tissue damage, reduces patient recovery times, and improves overall outcomes. Furthermore, the development of new medical imaging techniques and diagnostic tools often incorporates laser-based systems. With the global medical devices market projected to exceed $600 billion, the demand for specialized laser materials that meet stringent regulatory and safety standards is experiencing robust growth.

-

Explosive Growth in Telecommunications and Data Transfer: The backbone of the modern digital economy is built upon fiber-optic networks, which are fundamentally dependent on laser diodes for data transmission. The insatiable global demand for high-speed internet, cloud computing, and 5G infrastructure is driving massive investments in these networks. Laser materials are critical for producing the semiconductor lasers and optical components that generate and modulate light signals, allowing for the transfer of vast amounts of data over long distances with minimal loss. The ongoing rollout of 5G and the early planning stages for 6G technology ensure that this driver will remain potent for the foreseeable future, requiring materials capable of handling ever-increasing data rates and frequencies.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/264130/global极光材料-market-2024-161

Significant Market Restraints Challenging Adoption

Despite its promise, the market faces hurdles that must be overcome to achieve universal adoption.

-

High Costs of Advanced Material Development and Processing: The research, development, and manufacturing of high-performance laser materials involve significant capital expenditure and operational costs. Producing optical-grade crystals, ultra-pure metals, and specialty ceramics requires sophisticated equipment, controlled environments, and highly skilled labor, which can elevate production costs by 25-50% compared to standard industrial materials. For instance, developing a new semiconductor laser compound with specific wavelength properties can take years and millions of dollars in R&D investment. This high cost structure ultimately translates to more expensive end-products, which can be a barrier to adoption for cost-sensitive applications and markets.

-

Technical Complexity and Integration Challenges: Integrating advanced laser materials into functional systems is not a straightforward process. Different materials have unique thermal expansion coefficients, optical properties, and mechanical behaviors. Ensuring that all components within a laser assembly work in harmony under intense thermal and optical loads is a significant engineering challenge. Mismatches can lead to system failures, reduced lifespan, or degraded performance. This complexity often requires custom solutions and extensive testing, which lengthens development cycles and adds to the overall cost and difficulty of bringing new laser technologies to market.

Critical Market Challenges Requiring Innovation

The transition from laboratory success to industrial-scale manufacturing presents its own set of challenges. Achieving and maintaining material purity and consistency at high production volumes is exceptionally difficult; even minute contaminations or crystalline defects can drastically impair laser performance and yield. For many specialty crystals and glasses, achieving a yield of high-quality, usable material can be as low as 60-70%, creating waste and escalating costs.

Furthermore, the market contends with the rapid pace of technological obsolescence. As laser applications evolve, the requirements for materials change. A material perfect for today's high-power cutting lasers may be inadequate for tomorrow's quantum computing or LiDAR sensors. This creates a persistent pressure on material suppliers to continuously innovate and invest in next-generation solutions, often before a clear return on investment from the current generation is realized. This cycle of innovation demands substantial and sustained R&D investment.

Vast Market Opportunities on the Horizon

-

Next-Generation Consumer Electronics and Displays: The consumer electronics sector presents a massive growth avenue. The development of micro-LED and advanced OLED displays for smartphones, AR/VR headsets, and ultra-high-definition televisions relies heavily on precise laser lift-off and transfer processes. These manufacturing techniques require lasers with specific properties, driving demand for new material compositions that can deliver these capabilities reliably and at scale. The sheer volume of the consumer electronics market means that even a single adopted technology can generate enormous demand for specific laser materials.

-

Advancements in Defense and Aerospace Technologies: The defense sector is a key innovator and adopter of advanced laser technologies, particularly for applications like LiDAR for autonomous navigation, target designation, and directed energy weapons. These applications push the boundaries of laser power, efficiency, and durability, requiring materials that can perform reliably in extreme conditions. The global aerospace and defense market's continuous drive for technological superiority ensures a steady stream of challenging requirements and funded development projects for laser material scientists and manufacturers.

-

Strategic Material Innovations for Sustainability: As the world focuses on sustainability, opportunities are emerging for laser materials that enable green technologies. This includes lasers for more efficient solar cell manufacturing, processes for recycling rare-earth elements, and systems for environmental sensing and monitoring. Developing materials that improve the energy efficiency of lasers themselves is also a critical goal. Companies that can innovate in these areas are positioning themselves to capitalize on the growing regulatory and consumer push for sustainable technological solutions.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented into Metals, Ceramics, Plastics, Glass, and others. Metals hold a significant share due to their critical role in laser system housings, heat sinks, and electrodes, where superior thermal conductivity and structural integrity are paramount. High-purity ceramics are essential for laser gain media and insulating components because of their ability to withstand extreme thermal and optical stresses. Specialty glasses are fundamental for lenses, windows, and optical fibers, prized for their precise optical properties and homogeneity.

By Application:

Application segments include Military, Electronics & Communication, Automobiles, and others. The Electronics & Communication segment is a dominant and high-growth area, driven by the endless demand for faster data transfer and smaller, more powerful electronic devices. The Automobile segment is rapidly expanding as advanced driver-assistance systems (ADAS) and vehicle automation integrate more LiDAR and sensor technologies. The Military sector remains a key consumer of high-performance materials for specialized and ruggedized applications.

By End-User Industry:

The end-user landscape is diverse, including Electronics, Automotive, Aerospace, Healthcare, and others. The Electronics industry is the largest consumer, leveraging laser materials for device fabrication, communication components, and display manufacturing. The Healthcare and Automotive industries are emerging as vital growth sectors, reflecting the trends in medical technology innovation and the automotive industry's technological transformation.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/264130/global-laser-material-market-2024-161

Competitive Landscape:

The global Laser Material market is fragmented and highly competitive, characterized by the presence of both large multinational chemical companies and specialized material producers. Competition is intense, focused on material purity, performance characteristics, product consistency, and the ability to form strategic partnerships with laser OEMs.

List of Key Laser Material Companies Profiled:

-

DowDuPont

-

Taishan Fibreglass

-

Deveron Resources Ltd

-

Triton Minerals Ltd

-

Scott AG

The competitive strategy is heavily focused on continuous research and development to push the boundaries of material performance, reduce production costs, and develop application-specific solutions. Forming long-term supply agreements and technical partnerships with leading laser manufacturers is also a critical strategy for securing market position.

Regional Analysis: A Global Footprint with Distinct Leaders

-

Asia-Pacific: Is the dominant force in the global laser material market. This leadership is driven by the region's colossal manufacturing base for electronics and consumer goods, particularly in China, South Korea, and Japan. Massive investments in telecommunications infrastructure, a booming automotive sector, and strong government support for high-tech industries fuel demand. The region is both a major producer and consumer of laser materials.

-

North America and Europe: Together, they form a powerful innovation-centric bloc. North America's strength, led by the U.S., lies in its advanced aerospace, defense, and medical technology sectors, which demand cutting-edge, high-performance materials. Europe possesses a strong base in industrial manufacturing, automotive excellence, and chemical production, with companies leading in specialty glass and high-purity chemical manufacturing. Both regions are hubs for fundamental research and development in laser technologies.

-

Rest of the World: Regions including South America and the Middle East & Africa are emerging markets. Growth here is primarily driven by increasing industrialization, infrastructure development, and the gradual adoption of advanced manufacturing and communication technologies. While currently a smaller part of the global picture, these regions represent significant long-term growth potential.

Get Full Report Here: https://www极光材料.24chemicalresearch.com/reports/264130/global-laser-material-market-2024-161

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/264130/global-laser-material-market-202极光材料4-161

About 24chemicalresearch

Founded in 201极光材料5, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time极光材料 price monitoring

-

Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness