Global Tin-Lead Alloy Bar Solder Market’s CAGR of 3.7%: Top 10 Companies Leading the Charge in 2034

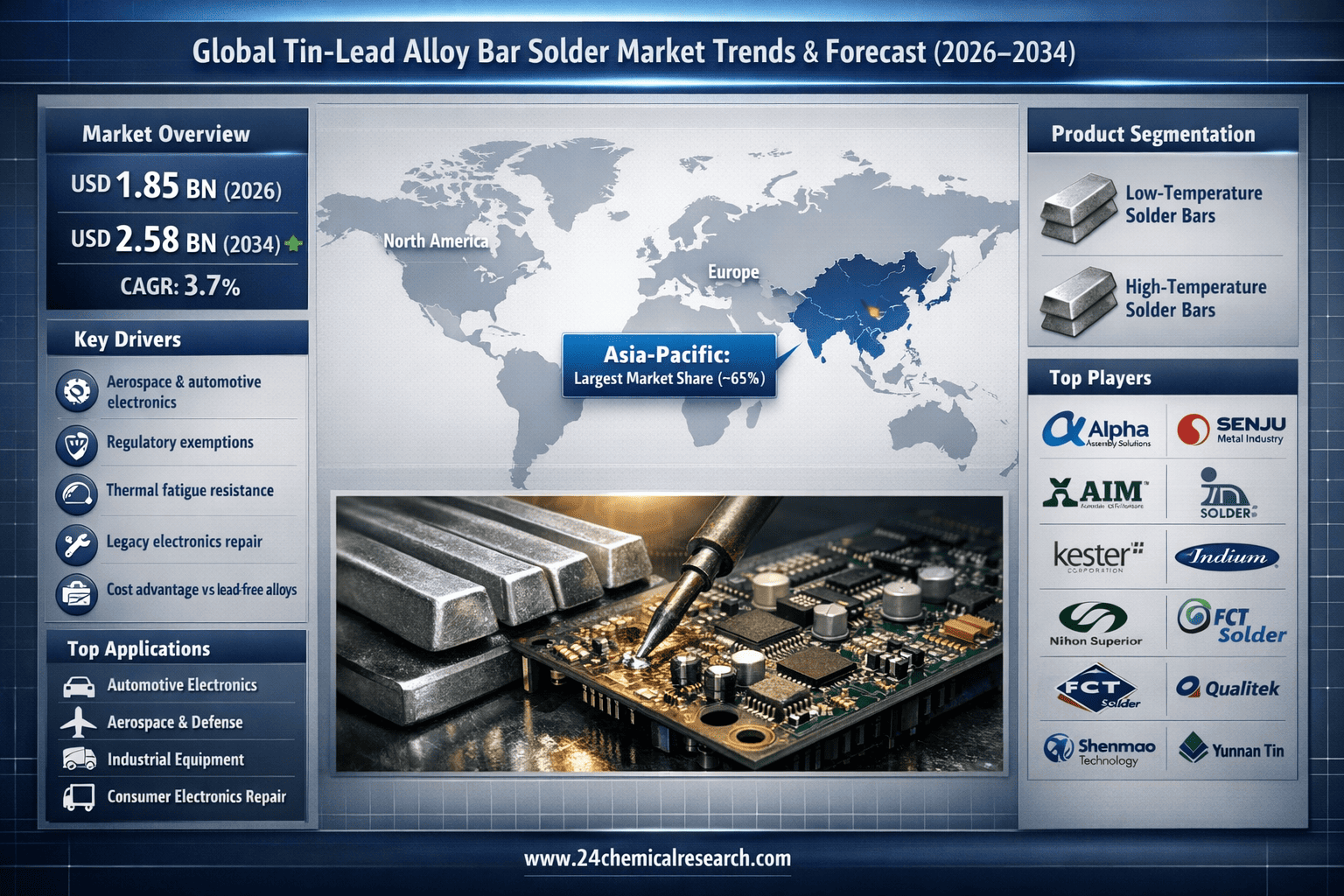

According to 24Chemical Research, Global Tin-Lead Alloy Bar Solder market was valued at USD 1.85 billion in 2026 and is projected to reach USD 2.58 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 3.7% during the forecast period.

Tin-Lead Alloy Bar Solder is a fundamental material in electronics manufacturing, primarily composed of tin and lead, with the most common formulation being 60% tin and 40% lead (Sn60/Pb40). This alloy remains indispensable for applications requiring exceptional wettability, reliable thermal fatigue resistance, and robust electrical conductivity. While environmental regulations have accelerated the adoption of lead-free alternatives in consumer electronics, tin-lead solder continues to dominate high-reliability sectors such as aerospace, automotive electronics, and industrial equipment where its proven performance and lower processing temperatures provide critical advantages.

Get Full Report Here: https://www.24chemicalresearch.com/reports/306460/tinlead-alloy-bar-solder-market

Market Dynamics:

The market's trajectory reflects a complex balance between sustained demand from exempted applications and the overarching transition toward lead-free solutions across global manufacturing sectors.

Powerful Market Drivers Propelling Expansion

-

Sustained Demand from High-Reliability Applications: The aerospace, defense, and automotive industries continue to drive consistent demand for tin-lead bar solder due to regulatory exemptions and performance requirements. These sectors prioritize the alloy's proven track record in thermal cycling performance and joint reliability, particularly in safety-critical systems where failure is not an option. The automotive industry alone accounts for approximately 25% of tin-lead solder consumption in exempted applications, primarily in engine control units and safety systems where material reliability outweighs environmental considerations.

-

Cost-Effectiveness in Price-Sensitive Markets: Tin-lead alloys maintain a significant cost advantage over lead-free alternatives, particularly in regions with less stringent environmental regulations. The raw material costs for tin-lead solder are typically 15-20% lower than comparable SAC (tin-silver-copper) alloys, making them the preferred choice for manufacturers prioritizing economics over compliance. This cost differential drives sustained adoption in consumer electronics repair markets and industrial applications where RoHS compliance is not mandatory.

-

Legacy System Maintenance and Repair: The extensive installed base of electronic equipment manufactured before RoHS implementation creates ongoing demand for compatible soldering materials. Industrial control systems, telecommunications infrastructure, and power distribution equipment with expected lifespans exceeding 20 years require maintenance using original specification materials. This aftermarket segment represents a stable, recurring revenue stream that insulates the market from fluctuations in new equipment production.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/306460/tinlead-alloy-bar-solder-market

Significant Market Restraints Challenging Adoption

Despite its technical advantages, the market faces substantial headwinds from regulatory and perceptual challenges.

-

Stringent Environmental Regulations: The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations worldwide have dramatically reduced tin-lead solder usage in consumer products. Compliance requires manufacturers to implement separate production lines, maintain material segregation, and document exemption justifications, adding 10-15% to operational costs. These regulatory barriers effectively limit market expansion to specifically exempted applications.

-

Perception and Industry Shift: The electronics industry's collective movement toward "green" manufacturing has created a powerful perception that tin-lead solder is outdated technology. Major OEMs increasingly mandate lead-free processes throughout their supply chains, even for exempted applications, to simplify compliance and branding. This generational shift in engineering education and industry standards gradually erodes the knowledge base and application expertise for tin-lead soldering processes.

Critical Market Challenges Requiring Innovation

The market's transition to niche applications presents unique operational and technical challenges that require continuous innovation and adaptation.

Manufacturers face increasing difficulty in maintaining cost-effective production volumes as demand concentrates into specialized segments. Production lines originally designed for high-volume consumer electronics must now accommodate smaller batch sizes with more stringent quality requirements, increasing per-unit costs by 20-30%. Additionally, supply chain complexity has intensified as manufacturers must manage dual inventory systems for lead-containing and lead-free materials while ensuring absolute segregation to prevent contamination.

The technical workforce capable of optimizing tin-lead soldering processes is aging, with fewer new engineers receiving training in these traditional methods. This knowledge gap threatens process quality and innovation, particularly as applications become more demanding. Furthermore, raw material price volatility, especially for tin, creates budgeting challenges for both manufacturers and end-users, with price fluctuations of 15-25% annually complicating long-term planning.

Vast Market Opportunities on the Horizon

-

Specialization in High-Performance Applications: The movement toward application-specific solder formulations presents significant opportunities for manufacturers to develop premium products. Specialty alloys tailored for extreme temperature cycling, vibration resistance, or specific thermal conductivity requirements can command prices 30-50% above standard tin-lead solders. The aerospace and medical device sectors particularly value these customized solutions, creating high-margin niche markets.

-

Advanced Manufacturing Integration: The integration of tin-lead solders with modern manufacturing technologies represents a promising growth avenue. Automated soldering systems with closed-loop process control can optimize tin-lead applications while minimizing environmental exposure. These advanced systems improve consistency and reduce material waste by 15-20%, addressing both performance and environmental concerns while maintaining the technical benefits of traditional alloys.

-

Emerging Market Development: Regions with developing electronics manufacturing sectors present opportunities for tin-lead solder adoption where environmental regulations are less stringent. Countries across Southeast Asia, Africa, and South America are building electronics manufacturing capabilities with greater focus on cost-effectiveness than regulatory compliance. These markets could absorb production capacity as developed regions transition fully to lead-free alternatives.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented into Low Temperature Solder Bars and High Temperature Solder Bars. Low Temperature Solder Bars dominate the market, preferred for their ability to solder heat-sensitive components without damage. These alloys typically melt between 180°C and 190°C, making them ideal for consumer electronics and precision instruments. High Temperature Solder Bars find application in automotive and industrial settings where joints must withstand elevated operating temperatures, though they represent a smaller segment due to more limited application scope.

By Application:

Application segments include Consumer Electronics, Automotive Electronics, Industrial Equipment, and Aerospace/Defense. The Automotive Electronics segment shows the strongest growth trajectory, driven by exempted applications in safety-critical systems and the increasing electronic content in vehicles. While consumer electronics was historically the largest application, that segment has declined significantly due to RoHS compliance, with demand now concentrated in repair and maintenance rather than new production.

By End-User Industry:

The end-user landscape includes Electronics Manufacturing Services (EMS), Original Equipment Manufacturers (OEMs), and Repair/Aftermarket Services. The Repair/Aftermarket Services segment has emerged as the most stable end-user category, providing consistent demand unaffected by new product design trends. EMS providers continue to serve exempted applications for their OEM customers, though this business requires maintaining segregated production facilities and specialized process expertise.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/306460/tinlead-alloy-bar-solder-market

Competitive Landscape:

The global Tin-Lead Alloy Bar Solder market is moderately consolidated, with the top five players accounting for approximately 60% of market share. The competitive environment is characterized by established multinational manufacturers with extensive technical expertise and global distribution networks, competing primarily on product quality, technical support, and reliability rather than price.

List of Key Tin-Lead Alloy Bar Solder Companies Profiled:

-

Alpha Assembly Solutions (USA)

-

Senju Metal Industry (Japan)

-

AIM Solder (Canada)

-

Kester (ITW) (USA)

-

Qualitek (USA)

-

Nathan Trotter (LOCTITE) (USA)

-

Indium Corporation (USA)

-

FCT Solder (USA)

-

Dyfenco (Canada)

-

Nihon Superior (Japan)

-

Nihon Handa (Japan)

-

极速快3计划

-

Yunnan Tin (China)

-

Shenmao Technology (Taiwan)

The competitive strategy focuses on developing specialized alloys for high-reliability applications, providing technical support for process optimization, and maintaining stringent quality control to meet the exacting requirements of aerospace, automotive, and industrial customers. Manufacturers are increasingly forming strategic partnerships with end-users to co-develop application-specific solutions.

Regional Analysis: A Global Footprint with Distinct Leaders

-

Asia-Pacific: Dominates the global market with approximately 65% share, driven by China's massive electronics manufacturing industry and the widespread availability of cost-effective tin-lead alloys. The region benefits from less stringent enforcement of environmental regulations in many countries, allowing continued use in consumer products. Japan and South Korea maintain significant demand for high-reliability applications in automotive and industrial sectors.

-

North America: Accounts for approximately 20% of the global market, with demand concentrated in exempted aerospace, defense, and automotive applications. The United States maintains the largest market share within the region, driven by robust defense spending and a strong automotive industry. Canadian demand is more limited, focused primarily on industrial and telecommunications applications.

-

Europe: Represents approximately 12% of the global market, with usage strictly limited to exempted applications under RoHS regulations. Germany, France, and the United Kingdom lead regional demand, primarily in automotive and industrial sectors. European manufacturers face the most stringent regulatory environment, requiring comprehensive documentation and segregation for any tin-lead solder usage.

-

Rest of World: South America, Middle East, and Africa collectively account for the remaining market share, with demand driven by cost considerations rather than technical requirements. These regions often utilize tin-lead solder across all applications due to less developed regulatory frameworks, though this is gradually changing as environmental standards become more widespread.

Get Full Report Here: https://www.24chemicalresearch.com极速快3计划/home.php?mod=space&uid=1307656&do=profile&from=space

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/306极速快3计划/home.php?mod=space&uid=130765极速快3计划/home.php?mod=space&uid=1307656&do=profile&from=space极速快3计划&from=space

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time极速快3计划价格监测

-

Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness