AI in Insurance Market Transforms Risk Assessment and Customer Experience

The Artificial Intelligence (AI) in Insurance Market is undergoing rapid transformation as insurers increasingly adopt advanced digital technologies to enhance efficiency, accuracy, and customer engagement. Artificial intelligence—encompassing machine learning, natural language processing, computer vision, and predictive analytics—is redefining how insurance companies assess risk, process claims, detect fraud, and personalize services. As competition intensifies and customer expectations evolve, AI has become a strategic necessity rather than an optional innovation.

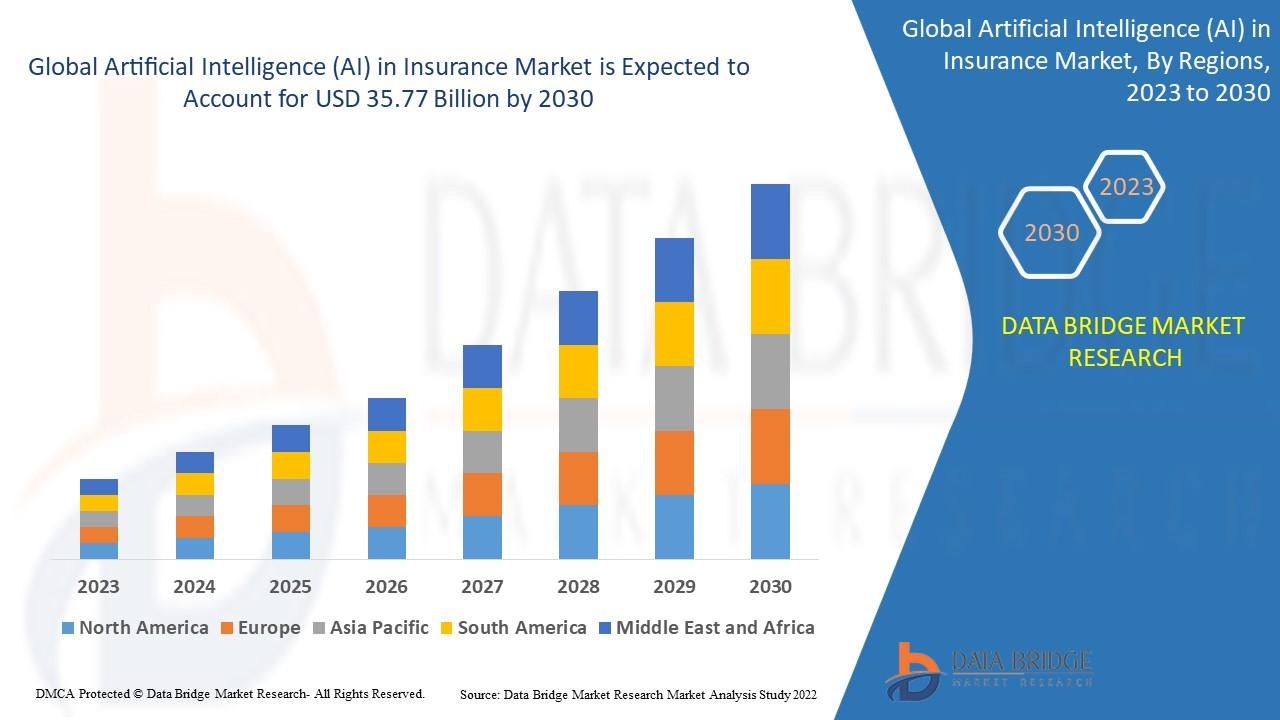

Driven by the need for operational efficiency, improved underwriting accuracy, and real-time decision-making, the global AI in insurance market is experiencing robust growth. Insurers across life, health, property, and casualty segments are leveraging AI-powered solutions to automate complex processes and gain data-driven insights, enabling faster, smarter, and more transparent insurance operations.

Market Overview

The AI in insurance market represents the integration of artificial intelligence technologies into insurance workflows, from policy issuance to claims settlement. Traditional insurance models relied heavily on manual processes and historical data. AI disrupts this approach by enabling insurers to analyze vast datasets, uncover hidden patterns, and predict future risks with higher precision.

The market includes AI-powered software platforms, analytics tools, and services designed to support underwriting, fraud detection, customer service, risk modeling, and compliance management. As digital transformation accelerates across the financial services sector, AI adoption in insurance continues to rise at a significant pace.

Uncover strategic insights and future opportunities in the Artificial Intelligence (AI) in Insurance Market. Access the complete report:

Key Drivers of Market Growth

Rising Demand for Automation and Efficiency

Insurance companies face mounting pressure to reduce operational costs while maintaining service quality. AI-driven automation minimizes human intervention in repetitive tasks such as data entry, document verification, and claims triaging. This results in faster processing times, reduced errors, and improved productivity, making automation a primary driver of the AI in insurance market.

Advanced Fraud Detection Capabilities

Insurance fraud remains a major financial burden for insurers worldwide. AI systems excel at identifying anomalous behavior and suspicious claim patterns in real time. Machine learning algorithms continuously learn from new data, improving fraud detection accuracy over time. The growing need to combat sophisticated fraud schemes is significantly fueling AI adoption.

Enhanced Customer Experience

Modern customers expect personalized, seamless, and digital-first insurance services. AI-powered chatbots, virtual assistants, and recommendation engines allow insurers to offer 24/7 support, customized policies, and instant responses. Improved customer engagement and retention are key factors accelerating market growth.

Improved Risk Assessment and Underwriting

AI enables insurers to assess risk more accurately by analyzing structured and unstructured data from multiple sources. Predictive analytics helps insurers price policies more precisely, reduce underwriting losses, and expand coverage to previously underserved customer segments.

Market Segmentation Analysis

By Technology

Machine learning dominates the AI in insurance market due to its ability to analyze historical data and predict outcomes. Natural language processing is widely used for document analysis, customer communication, and claims automation. Computer vision plays a critical role in damage assessment, particularly in property and automotive insurance.

By Application

Claims processing is one of the most prominent applications of AI in insurance, enabling faster claim approvals and settlements. Fraud detection and prevention represent another major segment, followed by underwriting and risk management. Customer service applications, including AI chatbots and virtual advisors, are gaining strong traction.

By Insurance Type

Property and casualty insurance leads AI adoption due to high claim volumes and fraud risks. Health and life insurance segments are also witnessing rapid growth, driven by the need for predictive health analytics, personalized coverage, and improved policyholder engagement.

Regional Insights

North America holds a leading position in the AI in insurance market, supported by early technology adoption, strong digital infrastructure, and the presence of major insurance providers. Europe follows closely, with increasing regulatory support for digital innovation and AI-driven compliance solutions.

The Asia-Pacific region is expected to experience the fastest growth, driven by expanding insurance penetration, rising digitalization, and growing investments in AI technologies. Emerging economies are leveraging AI to bridge protection gaps and improve insurance accessibility.

Competitive Landscape

The AI in insurance market is highly competitive, with both established technology firms and innovative startups offering AI-powered solutions tailored for insurers. Companies are focusing on product innovation, strategic partnerships, and platform integration to strengthen their market position. Continuous advancements in data analytics, cloud computing, and AI algorithms are intensifying competition and driving innovation.

Challenges and Restraints

Despite strong growth prospects, the market faces several challenges. Data privacy and security concerns remain critical, as insurers handle sensitive personal and financial information. Regulatory compliance related to AI transparency and ethical use also poses hurdles.

Additionally, high implementation costs and the complexity of integrating AI with legacy insurance systems can limit adoption, particularly among small and mid-sized insurers. Skill gaps and resistance to organizational change further restrain market expansion.

Future Outlook and Trends

The future of the Artificial Intelligence in Insurance Market is marked by increasing sophistication and deeper integration across insurance value chains. Explainable AI is gaining importance, allowing insurers to interpret and justify AI-driven decisions to regulators and customers. Usage-based insurance models, powered by real-time data analytics, are expected to grow significantly.

AI-driven predictive maintenance, climate risk modeling, and hyper-personalized insurance products will further reshape the industry. As AI technologies mature and regulatory frameworks evolve, insurers that embrace AI strategically will gain a strong competitive advantage.

Conclusion

The Artificial Intelligence (AI) in Insurance Market is revolutionizing the global insurance industry by enhancing operational efficiency, improving risk assessment, and delivering superior customer experiences. From fraud detection to claims automation and personalized policy offerings, AI is transforming every aspect of insurance operations.

Browse More Reports:

Global Water Treatment Chemicals Market

Global Scented Candle Market

Global Ceramics Market

Europe Japanese Restaurant Market

Global Smart Fleet Management Market

Global Tuna Market

Global Tote Bags Market

Global Gemstones Market

Global Japanese Restaurant Market

Global Hypochlorous Acid Market

Global Toothbrush Market

Global Cataracts Market

Global Wire and Cable Market

Global Plant-Based Food Market

Global Tomatoes Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness