Middle East and Africa Treasury Software Market Share, Trends and Strategic Forecast 2032

"Key Drivers Impacting Executive Summary Middle East and Africa Treasury Software Market Size and Share

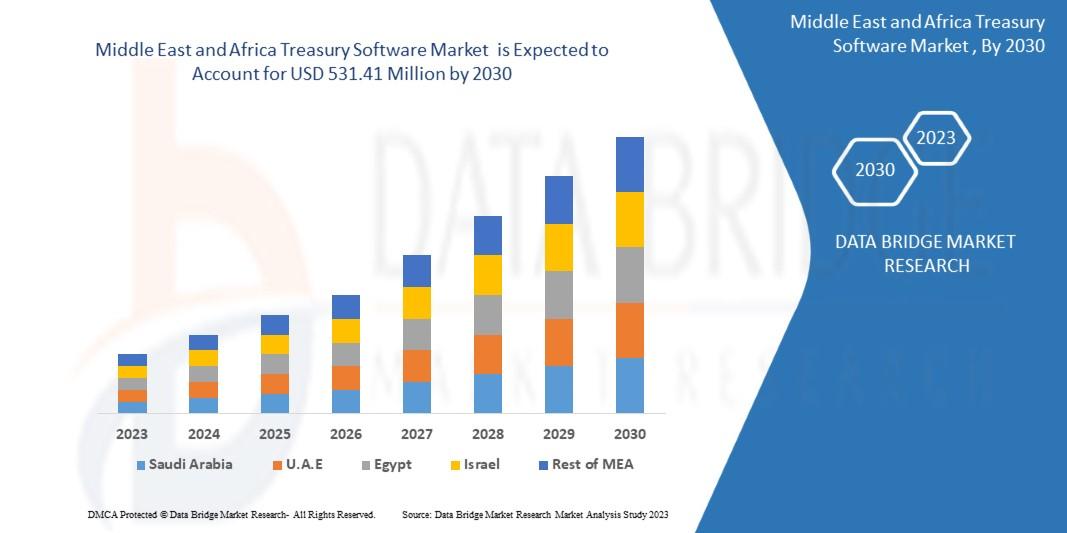

Data Bridge Market Research analyses that the market is growing with the CAGR of 2.5% in the forecast period of 2023 to 2030 and expected to reach USD 531.41 million by 2030

The large-scale Middle East and Africa Treasury Software Market report presents the best market and business solutions to Middle East and Africa Treasury Software Market industry in this rapidly revolutionizing marketplace to thrive in the market. This market research report is a watchful investigation of the current scenario of the market and future estimations, which spans several market dynamics. Market definition gives the scope of a particular product with respect to the driving factors and restraints in the market. Competitor strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions can be utilized well by the Middle East and Africa Treasury Software Market industry to take better steps for selling goods and services.

To improve customer experience while using this global market report, all the facts and figures of statistical and numerical data are represented very well. The Middle East and Africa Treasury Software report forecasts the size of the market with information on key vendor revenues, development of the industry by upstream and downstream, industry progress, key companies, along with market segment type and market application. Moreover, this data is also checked and verified by the market experts before publishing it in the market report and providing it to the client. This is the quality market report, which has transparent market research studies and estimations that support business growth.

Understand market developments, risks, and growth potential in our Middle East and Africa Treasury Software Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-treasury-software-market

Middle East and Africa Treasury Software Industry Trends

Segments

- By Component: The Middle East and Africa treasury software market can be segmented by component into software and services. The software segment is expected to hold a significant share of the market as organizations across various industries are increasingly adopting treasury software solutions to streamline their financial operations and enhance efficiency. On the other hand, the services segment is projected to witness substantial growth due to the rising demand for implementation, training, and support services to ensure the smooth integration and utilization of treasury software.

- By Deployment Model: Based on the deployment model, the market can be categorized into cloud-based and on-premises. The cloud-based segment is anticipated to experience rapid expansion owing to the advantages it offers, such as scalability, flexibility, and cost-effectiveness. In contrast, the on-premises segment is likely to maintain a steady presence in the market, particularly among large enterprises with specific security and compliance requirements that prefer to have complete control over their treasury software infrastructure.

- By Organization Size: The Middle East and Africa treasury software market can also be segmented by organization size into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly investing in treasury software solutions to automate manual processes, reduce operational costs, and improve financial decision-making. Large enterprises, on the other hand, are adopting advanced treasury software platforms to manage complex financial operations across multiple business units and geographies effectively.

Market Players

- Finastra

- Kyriba

- GTreasury (Agtos)

- Ivalua Inc.

- HighRadius

- SAP SE

- Oracle

- FIS

- Broadridge Financial Solutions, Inc.

- Fiserv, Inc.

The Middle East and Africa treasury software market is witnessing substantial growth due to the increasing adoption of digital transformation initiatives by organizations across various industries to streamline their financial processes and achieve operational efficiency. The market is characterized by the presence of prominent players offering a wide range of treasury software solutions tailored to meet the diverse needs of businesses in the region. With the rising demand for advanced financial management tools to effectively manage cash flow, liquidity, and financial risks, the market players are focusing on product innovations, strategic partnerships, and geographic expansion to gain a competitive edge and enhance their market presence.

The Middle East and Africa treasury software market is poised for significant growth as organizations in the region increasingly recognize the importance of leveraging technology to enhance their financial operations. With the push towards digital transformation initiatives, businesses are seeking efficient solutions to streamline their treasury functions, manage cash flow effectively, and mitigate financial risks. This shift is driving the demand for advanced treasury software solutions that can automate manual processes, improve decision-making, and optimize overall financial performance.

One key trend shaping the market is the focus on software and services components. While treasury software solutions play a crucial role in modernizing financial processes, the demand for accompanying services such as implementation, training, and support is also on the rise. Organizations are looking for comprehensive offerings that not only provide robust software capabilities but also ensure seamless integration and ongoing assistance to maximize the benefits of the technology.

Moreover, the deployment model is a critical factor influencing market dynamics. Cloud-based solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness, making them ideal for organizations looking to adapt quickly to changing market conditions. On the other hand, on-premises deployments continue to appeal to enterprises with stringent security and compliance requirements that prefer to have full control over their software infrastructure.

In terms of organization size, both small and medium-sized enterprises (SMEs) and large enterprises are investing in treasury software solutions for different reasons. SMEs are leveraging these technologies to automate manual processes, cut operational costs, and enhance financial decision-making capabilities. Meanwhile, large enterprises are turning to advanced treasury software platforms to manage complex financial operations across diverse business units and geographies efficiently.

The competitive landscape of the Middle East and Africa treasury software market is marked by the presence of key players such as Finastra, Kyriba, GTreasury (Agtos), SAP SE, Oracle, and others. These companies are actively innovating their product offerings, forging strategic partnerships, and expanding their geographical reach to cater to the evolving needs of businesses in the region. As the demand for sophisticated treasury solutions continues to grow, market players are emphasizing customization, integration capabilities, and user-friendly interfaces to stay ahead of the competition.

In conclusion, the Middle East and Africa treasury software market are poised for robust growth driven by the increasing adoption of digital transformation initiatives and the growing need for efficient financial management tools. With a diverse range of players offering tailored solutions for organizations of all sizes, the market is set to witness further advancements in technology and services to meet the evolving demands of modern businesses in the region.The Middle East and Africa treasury software market is experiencing significant growth as organizations in the region embrace digital transformation to optimize their financial operations. One of the key trends shaping this market is the increasing focus on the software and services components. While treasury software solutions are crucial for modernizing financial processes, the demand for complementary services like implementation and support is rising. Businesses are seeking comprehensive offerings that not only provide advanced software capabilities but also ensure seamless integration and ongoing assistance to maximize the benefits of the technology.

Another critical factor influencing market dynamics is the deployment model. Cloud-based solutions are gaining popularity due to their scalability, flexibility, and cost-effectiveness, making them attractive to organizations looking to adapt quickly to market changes. Conversely, on-premises deployments remain relevant for enterprises with strict security and compliance requirements that prefer to retain control over their software infrastructure.

In terms of organization size, both small and medium-sized enterprises (SMEs) and large enterprises are investing in treasury software solutions for distinct purposes. SMEs are leveraging these technologies to automate manual processes, reduce operational costs, and enhance decision-making capabilities. In contrast, large enterprises are adopting advanced treasury software platforms to efficiently manage complex financial operations across diverse business units and geographies.

The competitive landscape of the Middle East and Africa treasury software market features key players such as Finastra, Kyriba, GTreasury (Agtos), SAP SE, Oracle, and others. These companies are actively innovating their product offerings, forming strategic partnerships, and expanding their geographic reach to meet the evolving needs of businesses in the region. As the demand for sophisticated treasury solutions continues to grow, market players are focusing on customization, integration capabilities, and user-friendly interfaces to maintain a competitive edge.

In conclusion, the Middle East and Africa treasury software market is poised for robust growth driven by the escalating adoption of digital transformation initiatives and the escalating demand for efficient financial management tools. With a diverse range of market players offering tailored solutions for organizations of all sizes, the market is expected to witness further technological advancements and service enhancements to address the evolving requirements of modern businesses in the region.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-treasury-software-market/companies

Nucleus is Data Bridge Market Research’s cutting-edge, cloud-based market intelligence platform that empowers organizations to make faster, smarter, data-driven decisions. Designed for strategic thinkers, researchers, and innovators, Nucleus transforms complex macroeconomic indicators, industry-specific trends, and competitive data into actionable insights through dynamic dashboards and real-time analytics. With capabilities spanning market access intelligence, competitive benchmarking, epidemiological analytics, global trade insights, and cross-sector strategy modeling, the platform unifies diverse datasets to help businesses identify opportunities, assess risks, and drive growth across regions and industries. Built on a powerful neural analytics engine, Nucleus bridges the gap between raw data and strategic execution, enabling users to visualize emerging trends, benchmark performance, and make informed decisions with confidence.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/middle-east-and-africa-treasury-software-market

Middle East and Africa Treasury Software Market Reporting Toolkit: Custom Question Bunches

- What is the total valuation of the Middle East and Africa Treasury Software industry this year?

- What will be the future growth outlook of the Middle East and Africa Treasury Software Market?

- What are the foundational segments discussed in the Middle East and Africa Treasury Software Market report?

- Who are the dominant players in Middle East and Africa Treasury Software Market each region?

- What countries are highlighted in terms of revenue growth for Middle East and Africa Treasury Software Market?

- What company profiles are included in the Middle East and Africa Treasury Software Market report?

Browse More Reports:

Global Autonomous Data Platform Market

Global Becker's Myotonia Treatment Market

Global Bioethanol Yeast Market

Global Blaschko’s Lines Treatment Market

Global Blood Lancet Market

Global Carbon-black based Electrically Conductive Plastic Compound Market

Global Cement Paints Market

Global Crigler-Najjar Syndrome Treatment Market

Global Dermatology Small Molecule API Market

Global Embolization Particle Market

Global Food Encapsulation Market

Global Giant Cell Arteritis Drug Market

Global Hand Sanitizer Market

Global Hemato Oncology Testing Market

Global High-Resolution Melting Analysis Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness