What’s Fueling Aromatic Process Oil Market Toward USD 2.53 Billion by 2034?

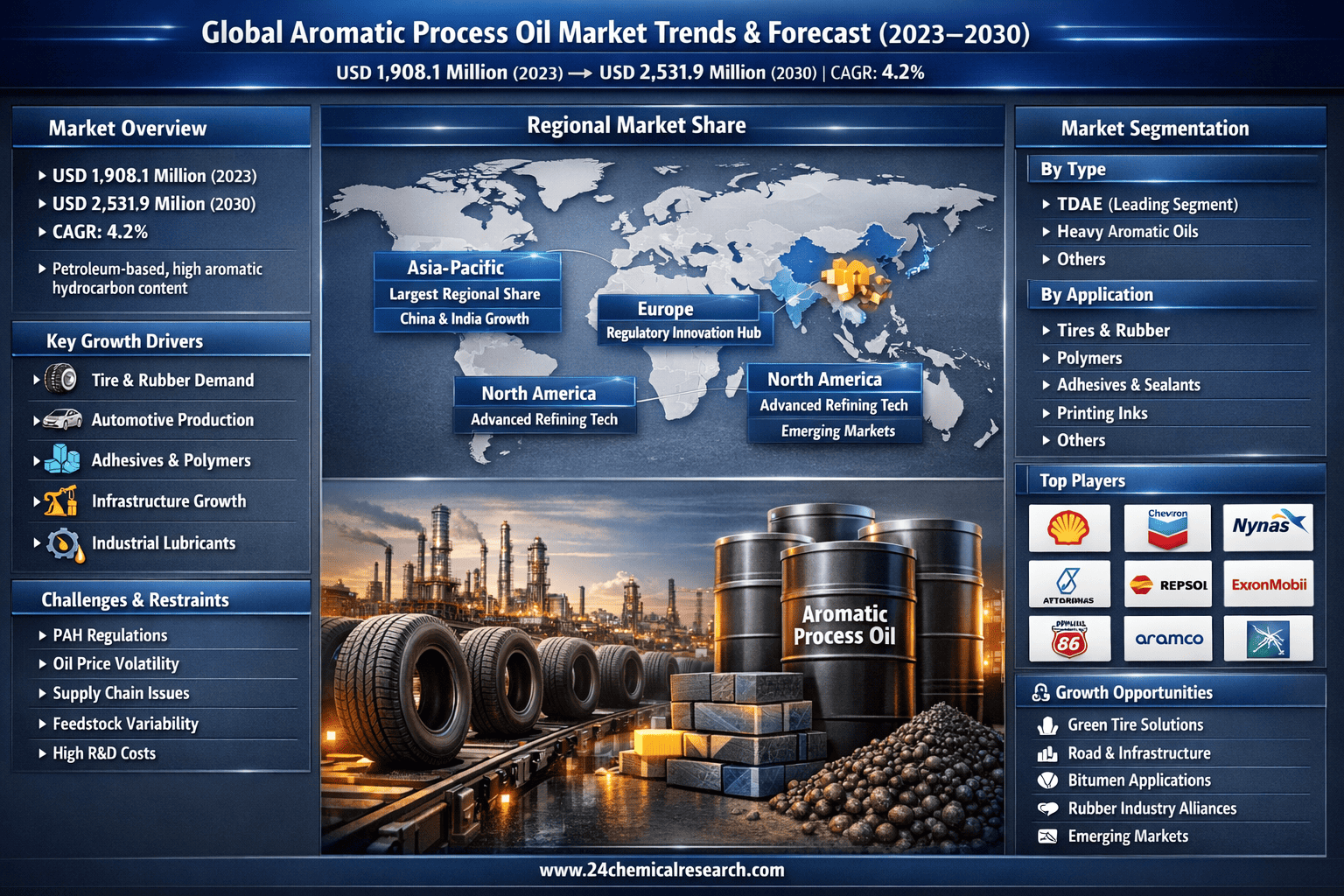

According to 24Chemical Research, Global Aromatic Process Oil market was valued at USD 1908.1 million in 2023 and is projected to reach USD 2531.9 million by 2030, exhibiting a steady CAGR of 4.2% during the forecast period.

Aromatic process oil, a key petroleum-derived product rich in aromatic hydrocarbons, has transitioned from a supporting role in industrial formulations to a vital component in modern manufacturing. Its distinctive properties—such as excellent solvency, compatibility with polymers, and ability to enhance viscosity—position it as an indispensable extender and plasticizer in various applications. Unlike aliphatic oils, aromatic process oils offer superior dispersion and processing aids in rubber and polymer compounding, making them easier to integrate into high-performance products like tires and adhesives.

Get Full Report Here: https://www.24chemicalresearch.com/reports/265870/global-aromatic-process-oil-market-2024-2030-333

Market Dynamics:

The market's trajectory is shaped by a complex interplay of powerful growth drivers, significant restraints that are being actively addressed, and vast, untapped opportunities.

Powerful Market Drivers Propelling Expansion

-

Boosting the Tire and Rubber Sector: The incorporation of aromatic process oils into tire manufacturing and rubber goods stands out as the primary growth engine. The global tire industry, valued at over $200 billion annually, constantly seeks materials that improve tread wear, flexibility, and processing efficiency. Aromatic oils excel in softening rubber compounds, allowing for better filler dispersion and reduced energy use during vulcanization. This leads to tires that last longer and perform better under diverse conditions, supporting the surge in vehicle production and replacement demand worldwide. Furthermore, as automotive trends shift toward more durable and eco-friendly tires, aromatic oils provide a cost-effective way to meet these standards without compromising quality.

-

Enhancing Polymer and Adhesives Applications: The polymer processing industry is undergoing significant evolution, propelled by the versatile nature of aromatic process oils. Their strong solvency power makes them ideal for plasticizing and extending polymers in adhesives, sealants, and coatings, where adhesion and elasticity are crucial. In particular, they enable the production of high-strength polymer blends used in construction and packaging. With the global adhesives market expanding rapidly due to urbanization and infrastructure projects, aromatic oils are gaining traction for their ability to lower production costs while maintaining product integrity. This compatibility also opens doors in specialty applications like bituminous products for road paving.

-

Supporting Industrial Lubricants and Inks: Innovation in formulations for printing inks and lubricants is transforming how aromatic process oils are utilized. In the printing sector, these oils improve ink flow and color dispersion, essential for high-quality offset and gravure printing. Meanwhile, in lubricants, they act as viscosity modifiers, enhancing performance in industrial machinery. The relentless demand for efficient manufacturing processes, especially in emerging economies, drives adoption as companies seek to optimize operations and reduce downtime. These enhancements not only improve end-product quality but also align with broader sustainability goals by enabling more efficient resource use.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/265870/global-aromatic-process-oil-market-2024-2030-333

Significant Market Restraints Challenging Adoption

Despite its promise, the market faces hurdles that must be overcome to achieve universal adoption.

-

Environmental and Health Regulations: The inherent presence of polycyclic aromatic hydrocarbons (PAHs) in traditional aromatic process oils raises concerns, leading to stringent regulations in major markets. Agencies like the EPA and EU's REACH impose limits on PAH content, requiring costly reformulations to low-PAH variants. This not only increases production expenses but also complicates compliance for manufacturers targeting export markets. While progress is being made, the transition period creates uncertainty, particularly for smaller producers who lack resources for rapid adaptation.

-

Volatility in Crude Oil Prices: As derivatives of crude oil, aromatic process oils are highly sensitive to fluctuations in global energy markets. Price swings can disrupt supply chains and squeeze margins for end-users in price-sensitive industries like tire manufacturing. Recent geopolitical tensions have exacerbated this issue, making long-term planning challenging and prompting some buyers to explore alternatives, even if they underperform in solvency.

Critical Market Challenges Requiring Innovation

The shift from conventional production to sustainable practices introduces several technical obstacles. Scaling up low-PAH aromatic oils while preserving their solvency characteristics proves difficult, with many processes yielding lower efficiency and higher waste. Moreover, ensuring consistent quality across batches remains elusive, as variations in feedstocks can alter oil composition, affecting performance in rubber compounding. These issues demand substantial investment in R&D, often accounting for a significant portion of operational budgets and deterring new entrants.

Additionally, the supply chain for aromatic process oils suffers from fragmentation and dependency on a few major refineries. Disruptions in logistics, coupled with rising transportation costs, add layers of complexity. Environmental pressures further complicate storage and handling, as stricter spill prevention measures increase overheads compared to other process oils.

Vast Market Opportunities on the Horizon

-

Sustainable Formulations for Green Tires: Aromatic process oils with reduced PAH levels are paving the way for eco-friendly tire production. These formulations support the development of low-rolling-resistance tires that improve fuel efficiency and cut emissions. As regulations tighten globally, particularly in Europe and North America, the push for sustainable mobility creates demand for such oils in the burgeoning green tire segment, where innovation can capture premium pricing.

-

Expansion in Construction and Infrastructure: The global infrastructure boom, especially in Asia-Pacific, offers fertile ground for aromatic oils in bitumen modification and polymer-based sealants. These applications benefit from the oils' ability to enhance durability and weather resistance in road surfaces and building materials. Recent advancements in treated distillates provide opportunities to meet evolving standards for longevity and recyclability in large-scale projects.

-

Collaborative Innovations with End-Users: Partnerships between oil producers and rubber manufacturers are accelerating the development of tailored solutions. Over recent years, numerous joint ventures have focused on customizing aromatic oils for specific polymer blends, shortening development cycles and addressing regulatory hurdles collectively. These collaborations bridge gaps in technology transfer, fostering market entry into niche areas like high-performance inks and advanced lubricants.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented into Treated Distillate Aromatic Extracts (TDAE), Heavy Aromatic Oils, and others. Treated Distillate Aromatic Extracts (TDAE) currently leads the market, preferred for its balanced solvency and compliance with low-PAH regulations, making it suitable for tire and rubber applications. Other types like heavy aromatics are crucial for inks and adhesives where high solvency is needed.

By Application:

Application segments include Tires & Rubber, Polymer, Adhesives & Sealants, Printing Inks, and others. The Tires & Rubber segment currently dominates, fueled by the steady demand in automotive and industrial rubber goods for improved compounding. However, the Polymer and Adhesives segments are poised for stronger growth, driven by construction and packaging expansions.

By End-User Industry:

The end-user landscape includes Automotive, Construction, Packaging, Printing, and Energy. The Automotive industry holds the largest share, utilizing aromatic oils in tire production and rubber components for enhanced performance. The Construction and Packaging sectors are emerging rapidly, reflecting trends in infrastructure development and sustainable materials.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/265870/global-aromatic-process-oil-market-2024-2030-333

Competitive Landscape:

The global Aromatic Process Oil market is moderately consolidated, marked by steady competition and ongoing refinements in production. The top companies—Royal Dutch Shell (Netherlands), Chevron Corporation (U.S.), and Nynas AB (Sweden)—collectively hold a substantial portion of the market as of 2023. Their leadership stems from robust refining capacities, compliance-focused innovations, and extensive supply networks.

List of Key Aromatic Process Oil Companies Profiled:

-

Royal Dutch Shell (Netherlands)

-

Chevron Corporation (U.S.)

-

Nynas AB (Sweden)

-

Petronas Lubricants Belgium (Belgium)

-

Repsol S.A (Spain)

-

ORGKHIM Biochemical Holding (Russia)

-

Avista Oil AG (Germany)

-

Idemitsu Kosan Co., Ltd. (Japan)

-

Palmer Holland (U.S.)

-

Aramco (Saudi Arabia)

-

ExxonMobil (U.S.)

-

Phillips 66 (U.S.)

The competitive strategy centers on refining processes to minimize PAHs and expand capacity, while forging alliances with downstream industries to co-create compliant products, ensuring sustained demand amid regulatory shifts.

Regional Analysis: A Global Footprint with Distinct Leaders

-

Asia-Pacific: Emerges as the dominant force, capturing the largest market share due to booming automotive and construction sectors. This region's growth is propelled by rapid industrialization in countries like China and India, alongside robust demand for tires and polymers. Manufacturing hubs here benefit from proximity to refineries and cost advantages.

-

Europe & North America: Together, they account for a significant portion, with Europe leading in regulatory compliance and innovation for low-PAH oils. North America's strength lies in advanced refining technologies and steady demand from automotive giants. Both regions emphasize sustainability, driving investments in greener formulations.

-

Latin America, Middle East, and Africa: These areas represent emerging markets with untapped potential, fueled by infrastructure investments and growing vehicle ownership. While currently smaller, they offer long-term expansion through rising industrial activities and partnerships with global players.

Get Full Report Here: https://www.24chemicalresearch.com/reports/265870/global-aromatic-process-oil-market-2024-2030-333

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/265870/global-aromatic-process-oil-market-2024-2030-333

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time price monitoring

-

Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness